In December’s post, Recession Indicators: Thoughts for Non-Profit Investors, we noted that the U.S. is not currently in a recession, however, many commentators continue to discuss the likelihood and what this means for investors.

So where are we now? In sharing the Verger team’s thoughts on recent developments, we need to talk more about inflation and its role in the current economic cycle.

Recession Signals

In its February release, the Conference Board stated that it “still expects high inflation, rising interest rates, and contracting consumer spending to tip the US economy into recession in 2023.” Across the asset management community, the conversation has turned from “when” to “how bad?” and, inevitably, the role that the Fed will play in answering the latter.

Interest Rates & Inflation

Will the Fed continue to raise interest rates? To consider this question we need to explore their views on inflation. Many have said that the current Fed outlook for reverting to 2% inflation levels is overly optimistic.

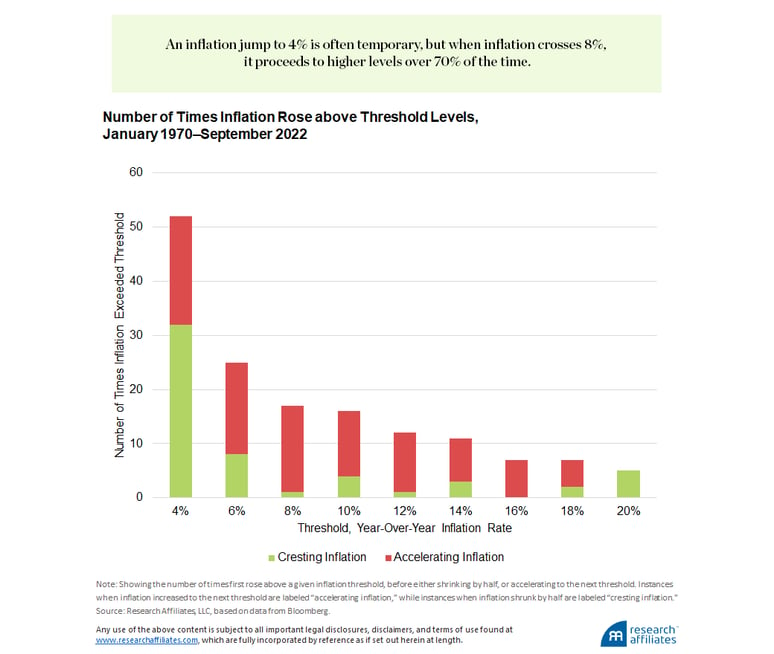

Take, for example, this work from Research Affiliates, who caution that we have crossed an inflation threshold that has historically signaled an extended period of high inflation to come.

Chart 1: Frequency of Accelerating Inflation (Red) After Year-Over-Year Inflation Rate Hits Thresholds

Source: Research Affiliates, History Lessons: How “Transitory” Is Inflation?, November 2022

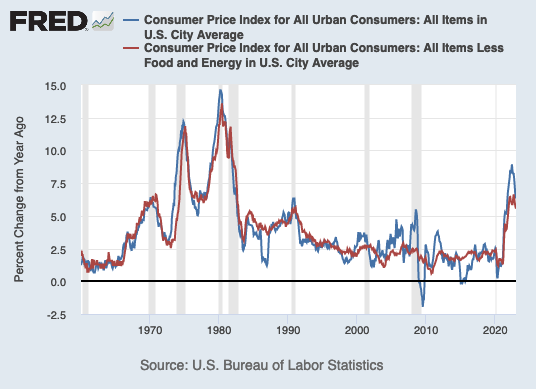

If these historical patterns repeat themselves, we could be facing an extended period of high inflation. As the chart below shows, US Headline Consumer Price Index (CPI) year-over-year change crossed the 8% threshold almost a full year ago.

Chart 2: Year-Over-Year Change in Headline CPI (Blue) Hits 1980s Levels

Source: FRED, Federal Reserve Bank of St. Louis, February 22, 2023

The Path Forward

While some argue that the recent drop in the year-over-year CPI figure is evidence that the Fed’s work may be near-to-done, others caution that near-term falling inflation is simply an illusion.

The work referenced above from Research Affiliates, for example, warns, “history tells us that once the inflation genie is out of the bottle, it can take far longer to return to normal levels than most people realize. Indeed, when Federal Reserve Chair Paul Volker took office in 1979, he pushed the fed funds rate to an unprecedented 20%, 5% above the previous peak inflation rate, the equivalent of today’s Fed embracing double-digit rates. Even so, it took two more years for this extreme policy intervention to cut inflation to half its peak level (to 7%), and over six years to bring inflation to 2%.”

So, are additional rate increases likely? History suggests that the answer is yes, and potentially higher than anyone is currently willing to say out loud. Uncertainty around upcoming actions from the Fed, coupled with the collective vertigo from inflation figure heights, may be enough to increase the likelihood of a hard landing.

What Does it Mean for Verger and Our Clients?

As we noted in December, our focus on all-weather, antifragile portfolios allows Verger to view market volatility and recessions as an opportunity for us to lean into our portfolio liquidity and make opportunistic investments when others are looking for buyers at any price.

While we scour the market for attractive opportunities (check out our 2022 Q4 Market Outlook for a few examples), we remain convinced that versatility is key for weathering the continued storm. Now, as ever, our focus on true diversification, active portfolio management, and unconstrained idea generation puts Verger and our clients in a unique position to thrive during these challenging times.

All investments involve risk, including possible loss of principal.

Not all strategies are appropriate for all investors. There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives. Diversification does not ensure a profit or protect against a loss.

One cannot invest directly in an index, and unmanaged indices do not incur fees and expenses.

This article is being provided for informational purposes only and constitutes neither an offer to sell nor a solicitation of an offer to buy securities. Offerings of securities are only made by delivery of the prospectus or confidential offering materials of the relevant fund or pool, which describe certain risks related to an investment in the securities and which qualify in their entirety the information set forth herein. Statements made herein may be materially different from those in the prospectus or confidential offering materials of a fund or pool.

This article is not investment or tax advice and should not be relied on as such. Verger Capital Management (“Verger”) specifically disclaims any duty to update this article. Opinions expressed herein are those of Verger and are not a recommendation to buy or sell any securities.

This article may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although Verger believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed. Except where otherwise indicated, all of the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.