World Cup Wisdom

One of the most exciting spectacles in sports took place during the fourth quarter, FIFA’s World Cup. Say what you will about corruption among FIFA’s ranks, the questionable decision to host a soccer tournament in the desert, or any of the other (valid) criticisms, there will always be excitement surrounding the World Cup. This year was no different as cumulative TV viewership topped 5.4 billion with over 240 million (!) watching the final match.

That final match, the 64th match played in Qatar, the culmination of 4 years of qualifying, may likely go down as the most exciting World Cup in history. A major reason for the excitement, was that the outcome was ultimately decided by a shootout, with Argentina besting France for their third Cup. Our CEO, Jim Dunn, is a former goalkeeper, and he will tell you that a shootout seems like the most ridiculous way to settle the sport’s biggest event – the equivalent of settling the World Series with a homerun derby. That said, the irresistible excitement and drama of a shootout at the highest level of soccer (ahem, football) is second to none. The higher the stakes, the crueler they seem, and the line between jubilation and despair is razor thin.

In penalty kicks, so much of this pressure rests on the shoulders of the goalkeeper. A soccer goal is 8 feet high by 24 feet wide. 192 square feet. Be it a shootout or the normal course of play, it’s a huge area to defend from an opposing team of players capable of firing a ball toward you at blistering speeds. So, what’s a goalkeeper to do? Some just guess, lunging to one side or the other hoping for a positive outcome. Unfortunately, hope is not a great strategy for goalkeepers (or investors). A better strategy is to let the game come to you and play to the shooter’s mistake. You likely can’t save them all, but if you’re patient and wait for that mistake to come, you will have a higher likelihood of success in the long run. Patience. Waiting for the right opportunity. Taking advantage of others’ mistakes. A great goalkeeping strategy and some great thoughts for the current market climate.

Market Review

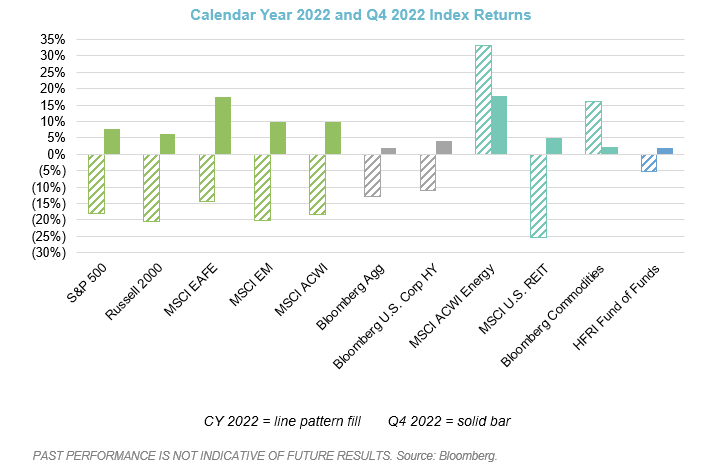

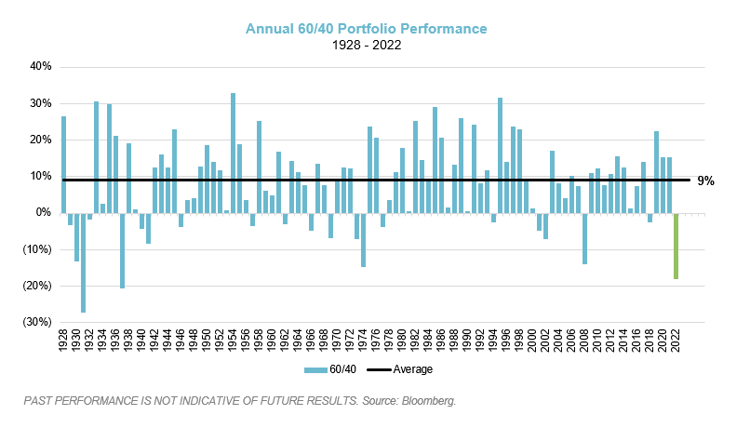

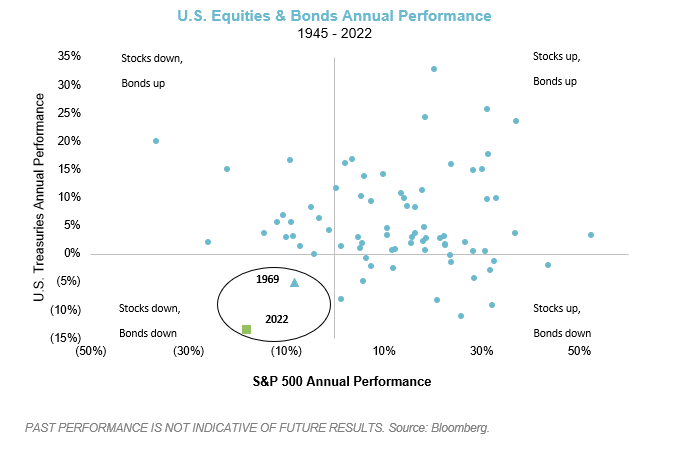

The fourth quarter represented the first positive quarter of the year but had little impact – like a meaningless goal in the waning minutes of injury time – and a December sell-off reminded us of just how painful 2022 has been for investors. Even with Q4’s recovery, 2022 was a year of worsts, as many indices had some of their worst years in history – S&P 500 (7th worst), 60/40 portfolio (3rd worst), and the worst year in history for a number of bond indices, including the Bloomberg Aggregate and the 10-year Treasury. This was easily the worst year for the overall markets since 2008.

In addition to the broad based declines we saw over the past year, we also saw even more dramatic shifts within specific sectors or assets. This was the year that technology companies and meme stocks came crashing back to earth from the moon. Equities overall were hit the hardest for the year, but growth suffered more than value, reversing a multiyear trend of value trailing growth. Further heartbreak was delivered by way of cryptocurrencies, both through large scale depreciation of several digital assets and by multiple instances of fraud, the largest among them being the FTX scandal.

On the other end of the spectrum, real assets, particularly energy and natural resources, were positive for both the quarter and the year. This is a result of many factors – the ongoing war in Ukraine, higher inflation, and rising rates across most central banks. With no end to the war (or inflation) in sight, continued supply and demand imbalances and the anticipation of a recession, we continue to see opportunity in real assets. Additionally, many absolute return strategies were positive, delivering on their promise of low beta, uncorrelated returns. Investors who valued diversification over concentration were rewarded for their patience as these diversifying strategies helped soften the blow of a dramatically disappointing year.

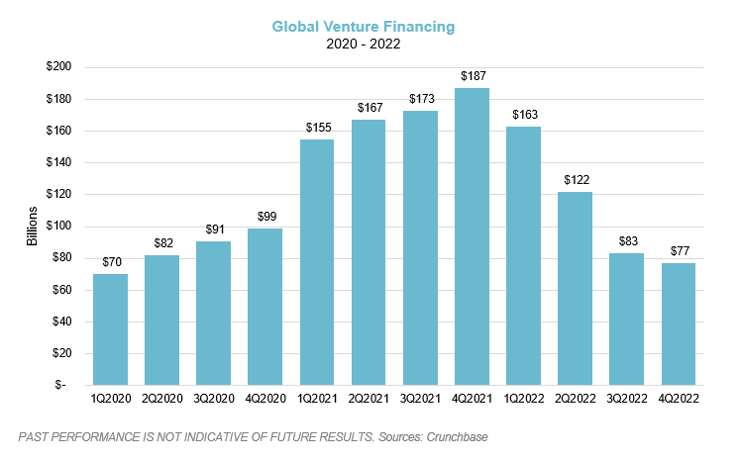

While private markets have held up better than public markets, overall investor sentiment has decreased significantly, making investors less willing to lock up their capital for long periods of time, which may make fundraising more difficult going forward. While startup financing levels are down 35% from 2021, the past year was still well above historical norms at $445 billion. However, all stages experienced significant declines in fundraising activity in the 2H 2022, with later stage startups taking the brunt of the pull back.

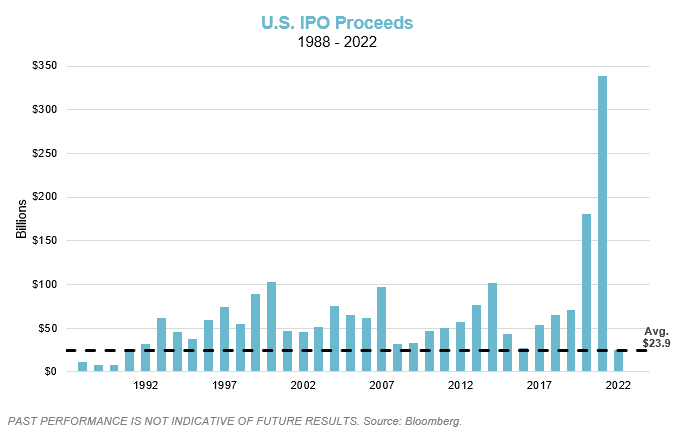

Rising rates have significantly increased the cost of capital and made deal financing more difficult. Exit activity in general has slowed down but is still within the normal range of what we have experienced over the past 10 years. What has changed is the type of exit – corporate M&A was the highest it has been since 2018 and sponsor acquisition (one fund buying from another fund) at the 2nd highest levels since 2012. However, public listings were essentially non-existent, with IPOs well below the highs of 2020 and 2021.

We think markdowns are on the horizon for many private assets and we have already seen some across a variety of private strategies. Within venture capital, some managers have been proactive in marking down positions throughout the year, with later stage companies that are more closely comparable to public markets taking the biggest hits. We expect that there will be further pullback once other managers conduct their annual audit at year end, which means it’s likely the market won’t see the impact of these markdowns until March or April.

Market Outlook

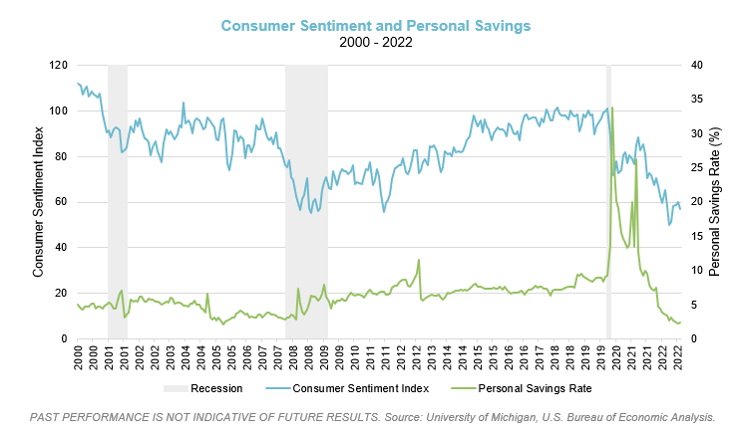

While our crystal ball is just as cloudy as those prognosticators who picked Brazil or Germany to win the World Cup, we do have some concerns about the coming year. Our concerns lie with the convergence of several factors that could put stress on the global economy and, in turn, global markets. As discussed earlier, inflation has broad implications going forward. Historically, sustained periods of high inflation correlate with both lower equity returns and at times, lower corporate earnings. The earnings piece is due in part to the impact inflation has on the consumer. Today, we see consumer sentiment and consumer savings at or below levels we haven’t seen since 2008 – 2010.

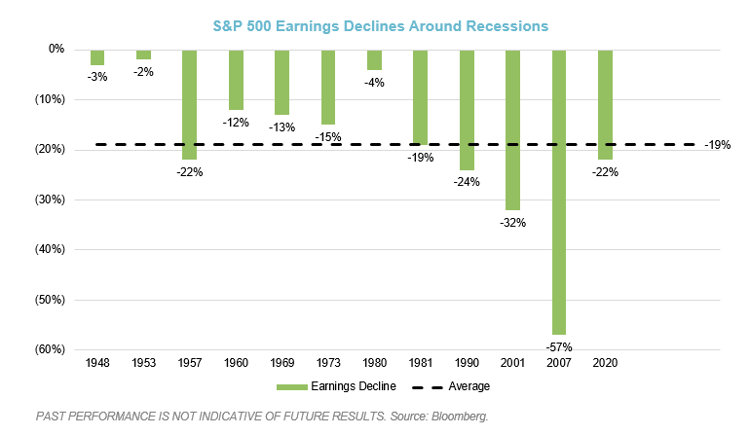

Along with these factors, we’ve seen a general weakening across the economy as consumers are under greater pressure due to layoffs, higher debt payments (mortgage, auto, credit card, etc.), higher food prices, and increasing defaults and delinquencies. All of this may eventually lead to declining consumer demand directly impacting corporate earnings and creating a domino effect throughout markets and economies. As the chart below illustrates, recessionary periods coincide with a 19% average decline in earnings.

Considering these concerns, as we look forward, we think the right approach needs to be a team effort. Argentina’s victory in the World Cup was not the result of one player – even if they do have one of the best in the business, Lionel Messi. No, their victory required contributions from all 11 players on the field and several substitutes. Likewise, we think a winning portfolio needs contributions from a diversified mix of asset classes and strategies, each designed to play a different role in changing market conditions. Given our position in the current cycle, we remain convinced that any portfolio needs components capable of capturing upside and others capable of protecting the downside. Offense wins games, defense wins championships.

Market Opportunities

As we consider how to best piece together this diversified mix of assets and seek contributions from across the spectrum of available strategies, there are a few that look particularly interesting. Generally speaking, credit opportunities are beginning to look more attractive given the significant rise in rates and widening of spreads recently. While we still think it may be too early to add significantly across broad U.S. credit, there are some niche areas (e.g., both commercial and residential mortgage securities) that are becoming attractive in part due to forced selling that is creating an opportunity to buy mispriced assets. Some of this forced selling is due to fund outflows as retail and institutional investors liquidate positions and from ratings changes that would force investors with specific mandates to sell out of assets that no longer meet their portfolio rating requirements.

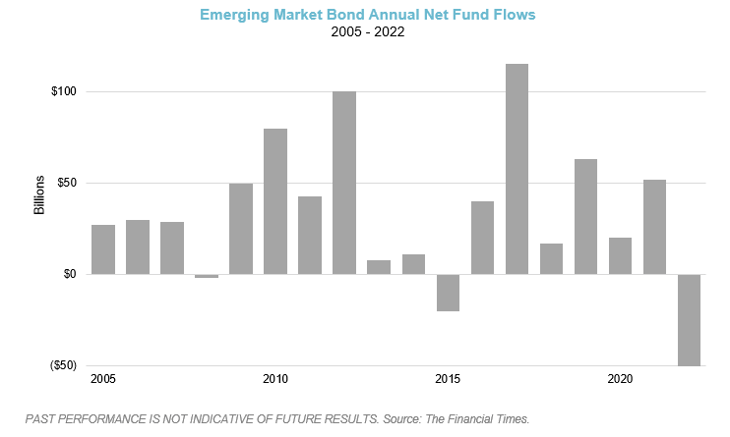

Another area where we and our managers are seeing opportunity is distressed debt, particularly in emerging markets economies. A variety of factors like rising interest rates, a strengthening U.S. dollar, the continuing war in Ukraine, and a multitude of China based concerns (slowing growth, a property crisis, etc.) have coalesced to impact emerging markets economies, which are typically a delicate balancing act even in their best days. This has led to the largest outflows from emerging market bond flows in the last 15+ years. Our managers are finding “niche” opportunities in areas such as Argentina, Ukraine, and the airline sector.

Closing Thoughts from Verger's CEO, Jim Dunn

In many ways, a great goalkeeper is one who’s steady; one who does their job consistently, week-in-week-out, with very few mistakes. I tell people, the biggest lesson I learned about being a CIO from being a goalkeeper was when you win, you had little to do with it, when you lose it’s all your fault.

Like success in asset management, success in goalkeeping is not defined by silky skills, showboating, or stealing the show. If anything, it’s more about keeping the limelight off you and focusing on winning the long game.

Also, like the team at Verger, keepers have to remain humble and fully accepting of the fact that glory may only come in the form of clean sheets, rare penalty saves, or those spectacular match-winning blocks. These are the moments that keepers strive for, patiently wait for, and build their careers around. Success at Verger is not measured in months or quarters but rather by our clients' long-term success.

Goalkeeping is also a role that requires so much from the team in front of you. There are 10 other players that dictate the pace and positioning. Even the substitute off the bench can have a big impact late in games. But, no one is sitting on the sidelines at Verger. Everyone is playing. Everyone is contributing. The same holds true for our clients’ portfolios. Every component, every strategy, every manager has its place and its role. Just like the 11 players on a soccer pitch.

As a parent who has played, coached, and has been around sports and soccer my entire life, I can identify with the challenge of coaching kids. Sports, to me, is a game. A game that gives you every chance and opportunity to prove that you’ve got what it takes to be great, on and off the field. It never takes away the chance, parents and coaches do. As a coach, you have the ability every game to put each player in the position to take advantage of the opportunity presented.

Investing is not a game, but like sports, it presents us with many of the same opportunities to prove our abilities. In soccer, every game won is an accomplishment, but the goal is not to win a single game, it’s to perform over the long term – a tournament, a season, a career. To look past those 90 minutes on the pitch and set your sights on long-term success. Similarly, a good quarter or year means very little in investing. As an investor, you must focus on the long-term – defend your liabilities, avoid permanent loss of capital, build a portfolio that can adapt and survive. Take advantage of opportunities, avoid dramatic mistakes, and support the missions and goals of your clients.

One of the great things about playing sports is accountability – there is no hiding when you miss a block, overthrow first base, or give up a late penalty – you must take responsibility for actions that don’t turn out well, just as you accept praise for the ones that succeed. The same is true in investing, we don’t get everything right. We learn, we evolve, we focus on the next play. 2023, we are ready.

Verger’s quarterly investment webinar covers market review and outlook in more depth and is open to qualified investors. To request an invitation to the next webinar to be held on February 9th at 1 pm ET, please contact us using the form found here.

All investments involve risk, including possible loss of principal.

Not all strategies are appropriate for all investors. There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives. Diversification does not ensure a profit or protect against a loss.

One cannot invest directly in an index, and unmanaged indices do not incur fees and expenses.

This article is being provided for informational purposes only and constitutes neither an offer to sell nor a solicitation of an offer to buy securities. Offerings of securities are only made by delivery of the prospectus or confidential offering materials of the relevant fund or pool, which describe certain risks related to an investment in the securities and which qualify in their entirety the information set forth herein. Statements made herein may be materially different from those in the prospectus or confidential offering materials of a fund or pool.

This article is not investment or tax advice and should not be relied on as such. Verger Capital Management (“Verger”) specifically disclaims any duty to update this article. Opinions expressed herein are those of Verger and are not a recommendation to buy or sell any securities.

This article may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although Verger believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed. Except where otherwise indicated, all of the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor's fees or other trading expenses.