Venture Capital (“VC”) has always been a topic of conversation among institutional investors, but no more so than over the past several years. We saw a meteoric rise in startup valuations in 2020-2021, driven by a flood of capital from both traditional and non-traditional investors. With investor capital supply outweighing startup demand, it was a more favorable environment for founders to raise that capital. Fast forward to today, and we are in a very different market environment, especially in Venture Capital. Many of the companies that raised financing rounds 2-3 years ago are now back in the market to raise their next round, as they have now burned through most of their capital. And per PitchBook, startup demand for VC dollars now outweighs the supply by nearly 2x (as of 9/30/2023). This has resulted in a more favorable market to deploy capital for investors.

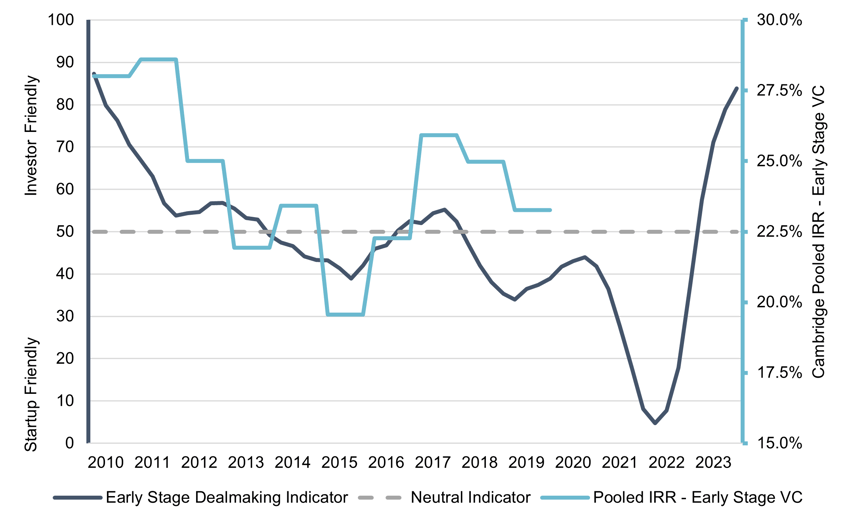

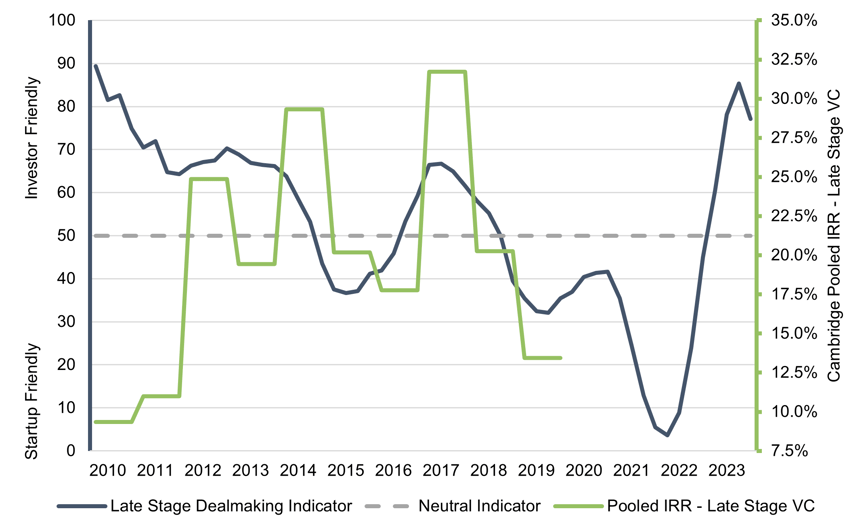

To measure the dealmaking environment, PitchBook collected deal-level data and incorporated deal terms and attributes, including liquidation preferences, board voting rights, valuations, and the supply-demand balance of capital, among other characteristics. Using this data, we can look at dealmaking environments dating back to 2010. In the charts below, any time the dark blue line is above the dotted neutral line, that is a more favorable market environment for Venture Capital investors, and anytime the dark blue line is below the dotted line is a market that is more favorable for startups.

Even more interesting is to look at the data in conjunction with Cambridge return data to highlight the correlation of dealmaking environment to returns. To do this, we calculated returns using pooled IRRs, which aggregates or pools all cash flows and NAVs from each fund represented in a vintage year, which aggregates or pools all cash flows and NAVs from each fund represented in a vintage year, for more mature vintages ranging from 2010 to 2019, as recent vintage years (2020-2023) are too immature to use. While not perfect, the correlation of pooled IRRs for both early and late stage venture capital to their respective dealmaking environments is strong. Given where we sit today with regard to the highly favorable environment for VC investors, at levels not seen for over a decade, now is a very interesting time to have dry powder in Venture Capital.

Chart 1: PitchBook Early Stage VC Dealmaking Indicator & Cambridge Pooled IRR - Early Stage VC

2010-2019 Vintages as of Q2 2023

Source: PitchBook VC Dealmaking Indicator; Cambridge U.S. Early Stage Venture Capital Pooled IRRs for 2010-2019 vintages as of June 30, 2023

Chart 2: PitchBook Late Stage VC Dealmaking Indicator & Cambridge Pooled IRR - Late Stage VC

2010-2019 Vintages as of Q2 2023

Source: PitchBook VC Dealmaking Indicator; Cambridge U.S. Late/Expansion Stage Venture Capital Pooled IRRs for 2010-2019 vintages as of June 30, 2023

What Does it Mean for Verger and our Clients?

At Verger, we continuously monitor and assess the potential risks and rewards of allocating to Venture Capital. We remain dedicated to our process, and we believe that our disciplined approach is key to building and sustaining this part of our portfolio. We are proud of the partnerships with our VC managers and continue to have conviction in the role these strategies play in supporting the missions of our non-profit clients.

All investments involve risk, including possible loss of principal.

Not all strategies are appropriate for all investors. There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives. Diversification does not ensure a profit or protect against a loss.

One cannot invest directly in an index, and unmanaged indices do not incur fees and expenses.

This article is being provided for informational purposes only and constitutes neither an offer to sell nor a solicitation of an offer to buy securities. Offerings of securities are only made by delivery of the prospectus or confidential offering materials of the relevant fund or pool, which describe certain risks related to an investment in the securities and which qualify in their entirety the information set forth herein. Statements made herein may be materially different from those in the prospectus or confidential offering materials of a fund or pool.

This article is not investment or tax advice and should not be relied on as such. Verger Capital Management (“Verger”) specifically disclaims any duty to update this article. Opinions expressed herein are those of Verger and are not a recommendation to buy or sell any securities.

This article may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although Verger believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed. Except where otherwise indicated, all of the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.