Inconceivable!

“You keep using that word. I do not think it means what you think it means.” - Inigo Montoya, The Princess Bride

Here at the Verger office, we often use movie quotes in conversation to get to the heart of a complicated concept with a few words. One often-quoted gem is from the 1987 (cult) classic film "The Princess Bride.” This satirical fantasy pokes fun at some of the common tropes of the genre, and is, in our opinion, the perfect blend of silly and smart to lend itself to a broad range of lessons and to this quarter’s market commentary.

Throughout the film, the heroes embark on adventures and repeatedly face their enemies, whether it be through a hand-to-hand duel or intellectual skirmish. One central conflict follows Vizzini, the cunning and (over)confident Sicilian, who sets a series of trials and traps for his nemesis, the Man in Black. After his enemy bests his first trial, Vizzini exclaims, “inconceivable!”. Moving forward, Vizzini doesn’t change or adjust his strategy accordingly, and for this reason, this simple word becomes a reoccurring joke as Vizzini shouts it again and again when the Man in Black repeatedly comes out on top.

This quarter saw the return of market volatility and while many investors sounded like Vizzini in their exclamations of surprise, we at Verger felt aligned with a different character from the movie, who turns to Vizzini, after he proclaims “inconceivable!” for the 100th time, and says, “You keep using that word. I do not think it means what you think it means.”

Based on recent (and longer-term historical) evidence, we feel it is easy to conceive of a world in which the Fed releases unexpected statements as part of its ongoing battle with inflation and recession, politics get in the way of effective fiscal policy, and investors who jumped into a narrow rally with both feet bail at the first signs of trouble.

Market Review

Why the return of market volatility this quarter? Some contributing factors included debt ceiling drama (inconceivable!), a rapid rise in Treasury yields (inconceivable!), and hawkish comments and interest rate projections from the Fed (inconceivable!).

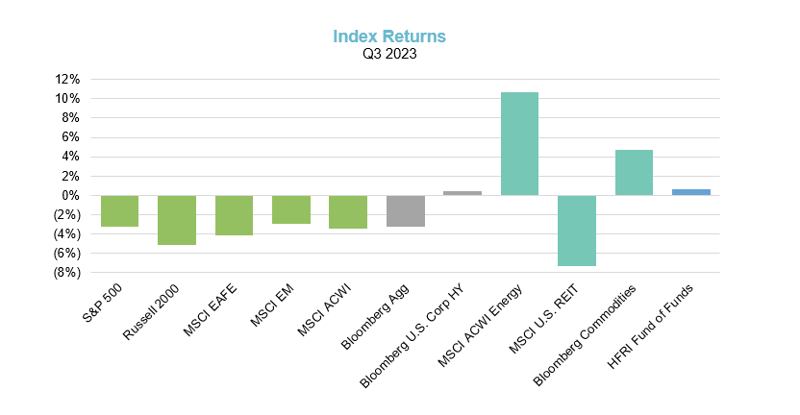

The darkening shadow of a sustained period of higher rates loomed large, and U.S. equity markets declined during the quarter. Most of the so called “magnificent seven” (see our Q2 commentary for the background on this epic-worthy term) were down for the quarter, weighing on the overall market. International equities suffered as well, especially for US domiciled investors where the rising dollar was a drag on performance.

The top performing index for the quarter was MSCI ACWI Energy, supported by notable increases in oil prices. Commodities also had their best quarter since Q1 2022. However, in the broader real assets category, agriculture and precious metals were down in line with equities.

Source: Bloomberg

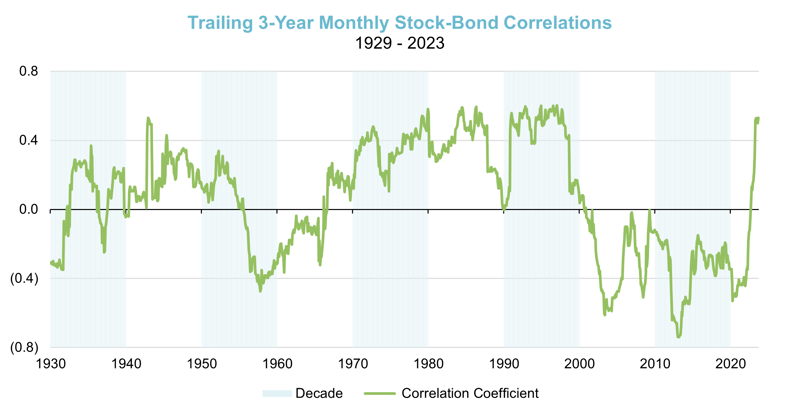

Continuing a trend from 2022, bonds (once again) did not provide diversification benefits, as the Bloomberg U.S. Aggregate Bond index declined more than 3% during the quarter. This is an instance where, we feel, the shout of “inconceivable!” from pundits and market players resonates with resounding irony.

While bonds have been good diversifiers (i.e., negatively correlated) to stocks for most of this century, the chart below shows that, over a much longer historical period (the last 90+ years), bonds have, more often than not, been positively correlated to equities.

Source: Bloomberg SBBI Ibbotson U.S. Large Stocks and U.S. LT Govt prior to 1989.

As we’ve noted in previous commentaries, we at Verger continue to believe that investors need to think differently about portfolio diversification, and that investment strategies such as real assets and uncorrelated hedge strategies play important, diversifying roles in portfolios.

Market Outlook

It seems reasonable to assume that even though investors are beginning to accept the prospect of sustained higher rates, global markets will remain quite sensitive to interest rate projections from the Fed. We can almost hear the resounding cry of “inconceivable!” following the next big announcement.

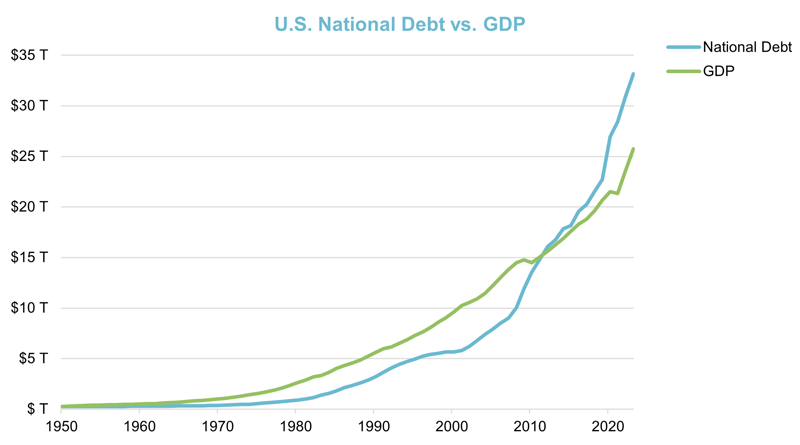

It is important to remember, however, that there are additional factors that may impact the future level of interest rates, beyond Fed rate hikes. Take, for example, supply and demand dynamics for U.S. Treasury bonds. As illustrated in the chart below, from a supply perspective, our national debt has been growing much faster than the economy.

Source: Treasury Department, Bureau of Economic Analysis; through September 2023.

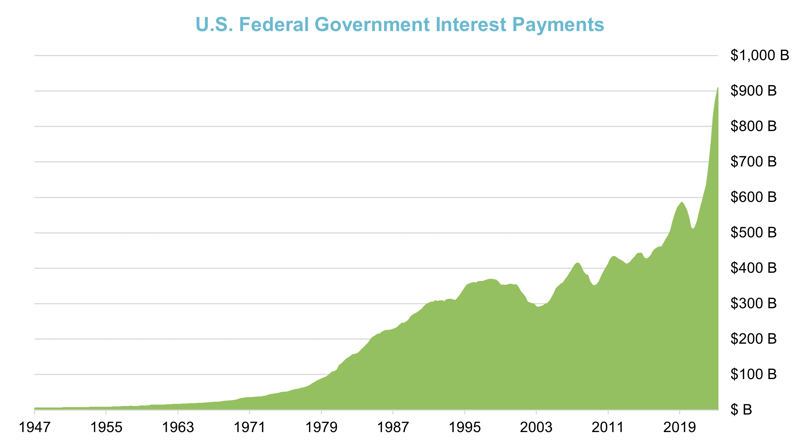

With the recent rise in interest rates, corresponding interest payments on our debt have increased significantly and are at all time highs (see chart below). Furthermore, during the pandemic, the Treasury Department failed to lock in interest rates that were at or near all time lows. As such, over 50% of the $33 trillion federal debt matures within the next three years and will very likely need to be refinanced at higher interest rates. This will likely lead to even higher interest payments.

Source: Source: US Bureau of Economic Analysis; through April 2023. Note: Seasonality adjusted at annual rates

Source: Source: US Bureau of Economic Analysis; through April 2023. Note: Seasonality adjusted at annual rates

From a demand perspective, many of the large sovereign buyers (e.g., China) are reducing their Treasury purchases. The Fed is now undergoing Quantitative Tightening, not Quantitative Easing. Going forward, if marginal buyers (e.g., asset managers, institutional investors) are more price sensitive, they may demand higher interest rates on U.S. Treasuries.

While these potential supply and demand imbalances may not lead to immediate concerns, they certainly can, over time, lead to higher interest rates. This only further exacerbates our fiscal outlook. It is, indeed, conceivable (and even probable) that we are facing a future with higher interest rates, and this will likely impact the valuation of many other assets. After all, most risk assets are priced at some premium to the risk free rate.

For us at Verger, the key objective is, as always, balancing the protection of our portfolio from what others may believe to be “inconceivable!” events, while, at the same time, positioning the portfolio to participate in attractive upside opportunities.

Market Opportunities

To this end, we, and our managers, have recently started to find opportunities in distressed and/or special situation investments. Examples include a manager buying “hung” bank debt at a discount from Wall Street firms, and a private equity manager making a synergistic acquisition of a distressed company looking to pursue “strategic alternatives.” One reason we like this particular space is that distressed allocations can be selective and targeted - only focused on the most attractive risk reward propositions.

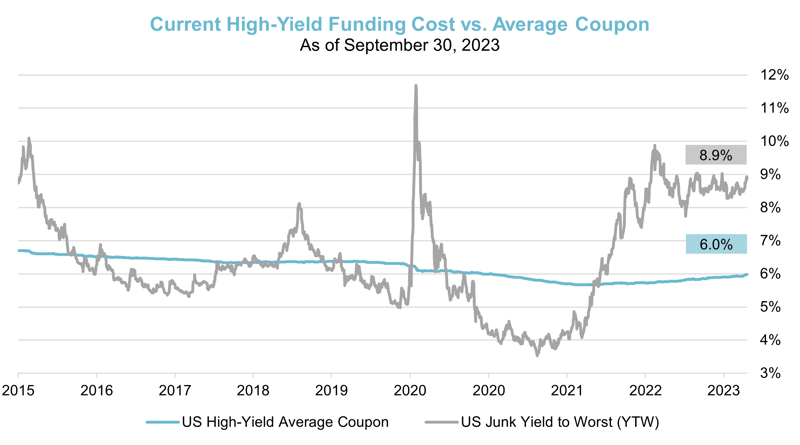

As the recent interest rate increases (and the potential of future ones) continue to work their way through the economy, we believe there will be opportunities to capitalize as more and more companies will need to either refinance or restructure. As the chart below demonstrates, for below investment grade companies, current market yields are approximately 3% higher than the average high yield coupon.

Source: Bloomberg

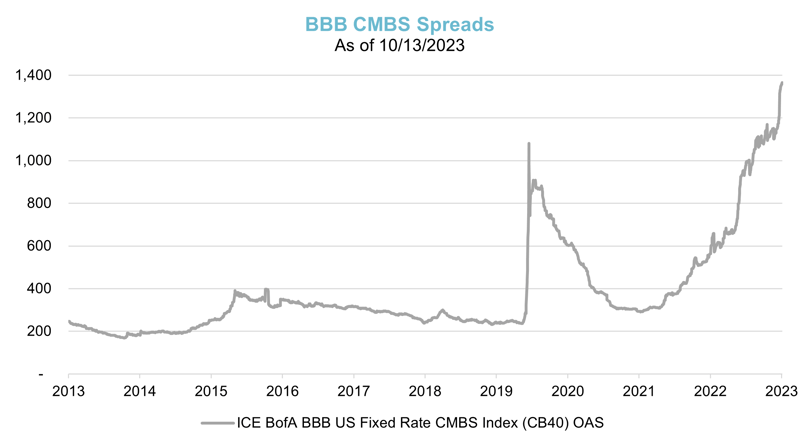

Meanwhile, on the mortgage side, there are an estimated $1.5 trillion in commercial mortgage loans that are coming due over the next three years. Commercial Mortgage Backed Security (CMBS) spreads are beginning to reflect some of these risks. As illustrated below, the average Option Adjusted Spread (OAS) is well above average long-term levels.

Source: Bloomberg

Source: Bloomberg

We plan to continue to monitor the distressed and special situation space with the possibility of identifying additional targeted, opportunistic investments. This is one example of how we can lean into our portfolio liquidity and take advantage of opportunities across market cycles to help bolster the portfolio’s long-term performance.

Closing Thoughts

One of our favorite scenes from “The Princess Bride” features Vizzini, in his final face-off with his nemesis – the “battle of the wits” - also known as “where is the poison?”. While Vizzini feels sure he has finally bested his opponent, he, in fact, has failed to appreciate the enemy’s breadth of skill.

This conflict resonates with us as we consider the current, intense showdown taking place with global central banks as they battle the dual opponents of inflation and recession. If you're running the Fed right now, you may feel a bit like our poor, doomed Vizzini. It turns out that both chalices are poisoned, and you simply must drink from one. The Fed’s focused efforts on defeating inflation will likely mean slowing growth and a recession. Focusing on delivering a soft landing, on the other hand, will likely mean higher costs of living and a weakened currency. There is no choice without serious economic consequences.

For this reason, we doubt this calendar year will end with the heroes riding off into the sunset (as they do at the end of the film). Markets still must contend with the aforementioned pain and traverse many obstacles. To name a few - slowing growth, rising debt, valuation concerns, domestic political maneuvering, and global geopolitical hostility. These make “fire swamps” and “rodents of unusual size” seem tame in comparison.

And yet - one overarching theme, and ultimately the heart and soul of the film, is the “impossible comeback.” Almost every character experiences a setback so severe, so crippling, that viewers may believe there’s no chance they can ever recover. The markets are the same - the setbacks come and go and evolve over time. At Verger, our goal is to experience less of the downside but be ready to participate in the upside opportunities. Protect, Perform, and Provide. That’s our mantra, and we honor it like the bond of true friendship displayed by this classic film’s heroes.

Verger’s quarterly investment webinar covers market review and outlook in more depth and is open to qualified investors. To request an invitation to the next webinar to be held on November 2nd at 1 p.m. ET, please contact us using the form found here.

All investments involve risk, including possible loss of principal.

Not all strategies are appropriate for all investors. There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives. Diversification does not ensure a profit or protect against a loss.

One cannot invest directly in an index, and unmanaged indices do not incur fees and expenses.

This article is being provided for informational purposes only and constitutes neither an offer to sell nor a solicitation of an offer to buy securities or otherwise engage Verger Capital Management for investment advisory services. Offerings of securities are only made by delivery of the prospectus or confidential offering materials of the relevant fund or pool, which describe certain risks related to an investment in the securities and which qualify in their entirety the information set forth herein. Statements made herein may be materially different from those in the prospectus or confidential offering materials of a fund or pool.

This article is not investment or tax advice and should not be relied on as such. Verger Capital Management (“Verger”) specifically disclaims any duty to update this article. Opinions expressed herein are those of Verger and are not a recommendation to buy or sell any securities.

This article may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although Verger believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed. Except where otherwise indicated, all of the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor's fees or other trading expenses.