Tour de France

“Life is short, and the Tour de France long." - Giles Smith

This year marks the 110th edition of the Tour de France, the most prestigious and demanding bicycle race in the world. And like the markets, the Tour is always challenging – and evolving. The three-week, grueling, 2,200+ mile route changes every year and, surprisingly, doesn’t start in France. This year it begins in Bilbao, Spain and in the previous five years it has started in the UK, the Netherlands, Germany, Belgium, and Denmark. Just like the Tour, economic and market cycles have different starting points, no two courses are alike, and the end is often out of sight.

The Tour de France, known for its grueling climbs and unpredictable crashes, provides us with a fitting comparison to the volatility and exhilaration witnessed in the global equity, debt, currency, and commodities markets during this quarter and fiscal year. During the Tour, cyclists face numerous, distinct stages and varying obstacles, from treacherous climbs to unpredictable weather conditions. Similarly, the last 12 months in global capital markets saw shifting economic indicators, geopolitical tensions, and the ever-present specter of inflation, making our journey as investors feel as though it required the endurance and resilience of the world's top cyclists.

Market Review

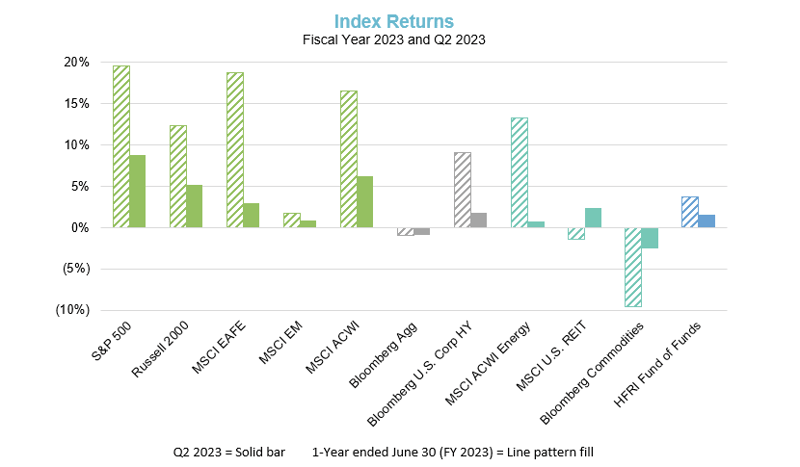

Much like the friendly terrain and the furious pace of the Tour's early flat stages, equities continued their rapid ascent in Q2, driven by corporate earnings, rising valuations, accommodative monetary policies, and positive sentiment surrounding the global economic recovery. Investors were buoyed by these strong tailwinds, resulting in impressive gains across various sectors and regions. Other risk assets, including high yield bonds (as measured by the Bloomberg US Corporate High Yield Index), also benefited from these tailwinds and were positive for the quarter.

Source: Bloomberg

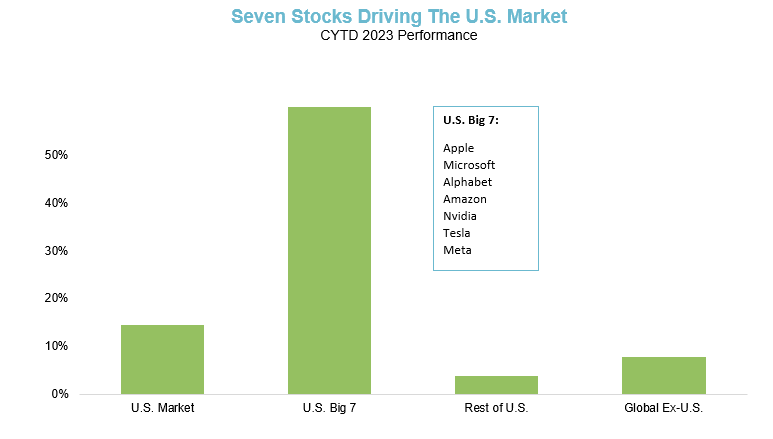

Unlike last year, when value stocks significantly outperformed growth stocks, the first six months of 2023 has seen a reversal, with growth stocks leading the way. In fact, equity returns this year have been driven by a small subset of the market… the so called “magnificent seven” – Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta, and Tesla. As illustrated in the following chart, while the S&P 500 is +17% so far in ’23, these seven stocks are up over 50%! In fact, if you exclude these stocks, the U.S. equity market is only up low to mid-single digits for the year.

Source: MRB Partners, Bloomberg

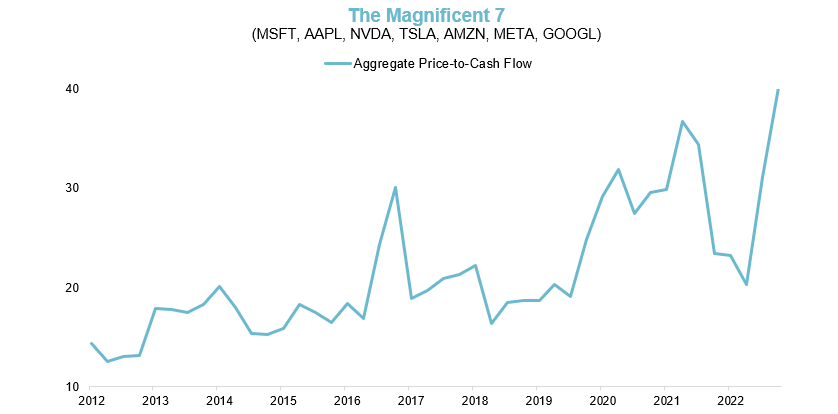

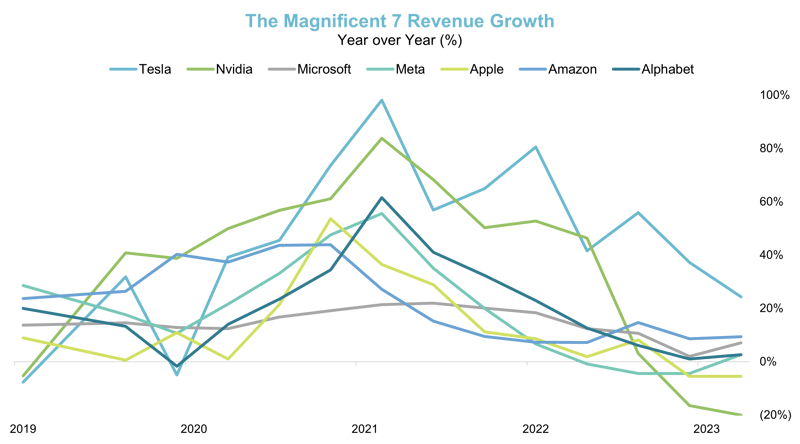

While most people would generally agree that these companies are solid businesses and have, at least historically, generated strong growth, we think a key question for investors is, how much of the good news for these companies is already reflected in the price of their stocks? As the following charts demonstrate, the valuation of these companies has increased significantly while, at the same time, their revenue growth rate has been slowing.

Source: Bloomberg

Source: Bloomberg

In this light, investors are left to wonder, what exactly has been driving the recent rally in this narrow group of growth stocks? One factor has been the excitement over artificial intelligence (AI). While AI has the potential to impact our economy and society, like many new technologies, it is often difficult to know, ex-ante, which companies will be the long-term winners. The AI industry will likely evolve rapidly, with continuous innovation and intense competition. New players can disrupt the market, and established companies may face challenges. Potential ethical and regulatory considerations also add complexity.

Additional factors driving the equity rally have been investor expectations – in particular, the view that future interest rate hikes are almost complete. There continues to be a lot of debate about whether the recent decline in inflation is transitory or not. While some believe it to be temporary, driven by factors such as supply chain disruptions and pent-up demand from COVID, others argue that it could be more persistent. While declining inflation, all else being equal, is no doubt good news for financial markets, it is still unclear whether the decline is the result of a slowing economy and portends future pressure on corporate profits.

Market Outlook

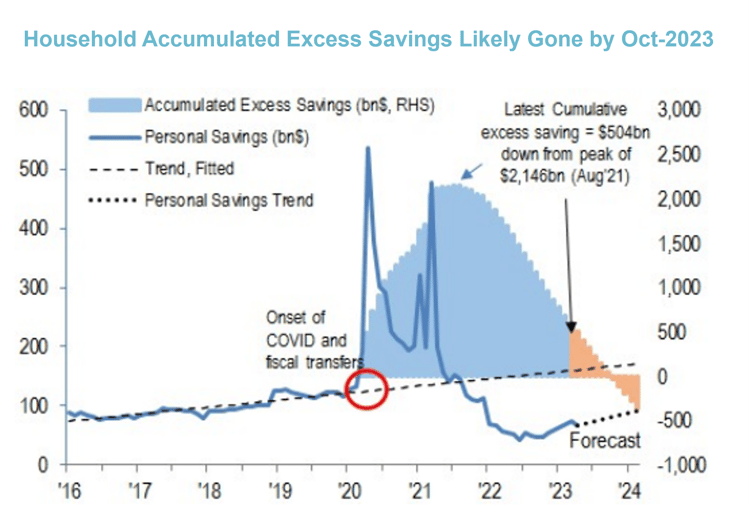

In the Tour, the later stages of the race contain challenging mountains. Indeed, looking forward to the remaining half of 2023, investors may have to contend with bumpier terrain. In addition to general uncertainty about inflation and resulting Fed action, the status of household balance sheets weighs heavily as we consider the health of the economy going forward. Over the last couple of years, many households have benefited from COVID-related stimulus initiatives. As noted in the chart, this “excess savings” has largely disappeared, which could have negative implications for consumer spending.

Source: J.P. Morgan Equity Macro Research

As in the Tour, even the most challenging stages can be followed by more pleasant rolling hills or flats. We remain cautious in our general outlook and are hesitant to label where exactly we are in the current course (i.e. if we’ve truly made it to easier stages). As always, we feel a long-term view and diversification are key for the route ahead.

Market Opportunities

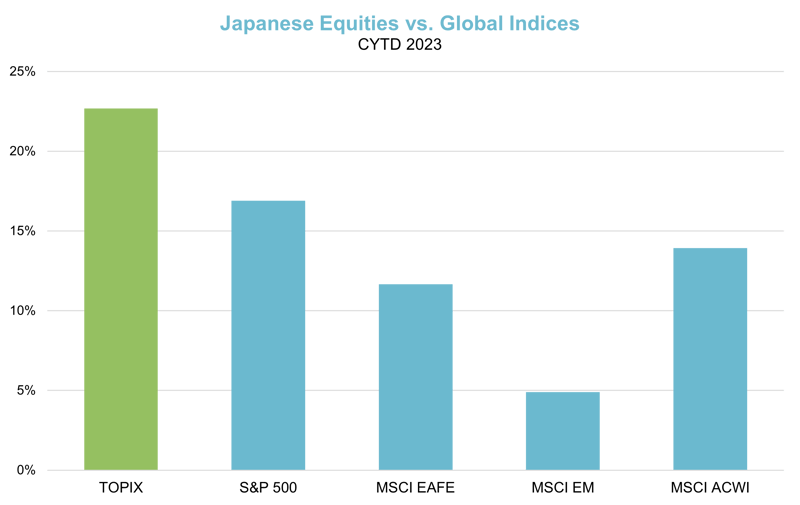

One investment area that we continue to find attractive is Japan. The country continues to have leading edge companies in many technology related areas, including automation, robotics, and advanced manufacturing. In addition, Japan has continued to implement corporate governance reforms that are focused on enhancing shareholder value and improving transparency. Finally, valuations and dividend yields are quite attractive compared to other equity markets.

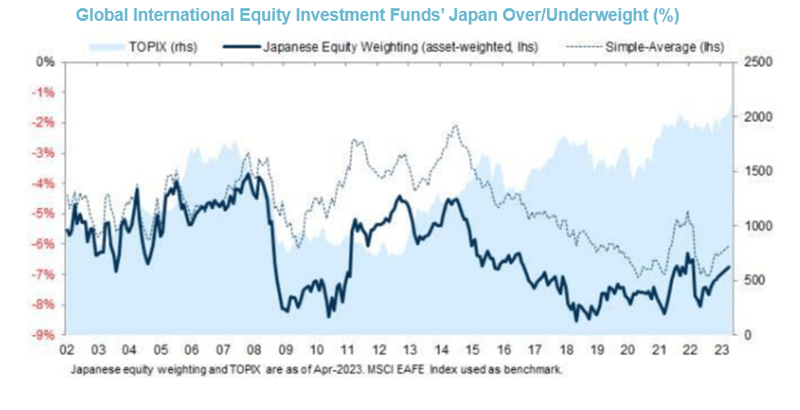

As the first chart below demonstrates, Japanese equities (as measured by the Tokyo Stock Price Index) have had a strong start to 2023. With attractive valuations and the average investor still underweight Japan (see the second chart below), we believe the opportunity for this equity market continues to be compelling.

Source: Bloomberg, TOPIX

Source: Goldman Sachs Investment Research

Source: Goldman Sachs Investment Research

The reinsurance industry is another interesting investment opportunity. Due to factors such as rising catastrophe losses, and the increased severity and frequency of natural disasters, the last several years have been challenging for reinsurance. However, these same factors have led to notably increased premiums now being charged by reinsurers, thus creating a potentially more attractive entry point for investment.

In addition, we find that reinsurance companies are shifting more of the risk back to the cedant (the entity purchasing the reinsurance). This is achieved through various means, including stricter underwriting practices, higher deductibles, and lower limits on coverage. Finally, enhanced portfolio diversification is another potential benefit of reinsurance, given the low expected correlation of catastrophes to equity market returns.

All investment strategies (including reinsurance) have some degree of risk. Similar to a cyclist assessing a race course, we believe the key question to answer is, do we feel our expected return is high enough to compensate us for the risks we are assuming? Given the current (higher) return and (lower) risk dynamics of reinsurance described above, we believe the answer, in this case, is yes.

Closing Thoughts

The Tour de France includes 21 stages over 23 days – varying from flat (6), hilly (6), mountains (8), and one individual time trial. While individual riders may win different stages of the course, the overall winner is the rider with the lowest cumulative time. In fact, three-time US winner Greg LeMond won the race in 1990 without winning a single stage. A balanced, well-rounded, consistent, and long-term-focused strategy is essential – for investing as well as cycling. For Verger, this strategy is our all-weather and antifragile investment approach.

Winning a stage or a quarter doesn’t give you the win, and while there is a conclusion to the Tour, there is no final whistle or finish line for non-profit institutions. Rather, the objective is to keep riding and taking advantage of tailwinds, avoid the crashes, and try to not be too influenced by the peloton (the main pack of riders) and the market noise.

Verger’s quarterly investment webinar covers market review and outlook in more depth and is open to qualified investors. To request an invitation to the next webinar to be held on August 3rd at 1 pm ET, please contact us using the form found here.

All investments involve risk, including possible loss of principal.

Not all strategies are appropriate for all investors. There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives. Diversification does not ensure a profit or protect against a loss.

One cannot invest directly in an index, and unmanaged indices do not incur fees and expenses.

This article is being provided for informational purposes only and constitutes neither an offer to sell nor a solicitation of an offer to buy securities or otherwise engage Verger Capital Management for investment advisory services. Offerings of securities are only made by delivery of the prospectus or confidential offering materials of the relevant fund or pool, which describe certain risks related to an investment in the securities and which qualify in their entirety the information set forth herein. Statements made herein may be materially different from those in the prospectus or confidential offering materials of a fund or pool.

This article is not investment or tax advice and should not be relied on as such. Verger Capital Management (“Verger”) specifically disclaims any duty to update this article. Opinions expressed herein are those of Verger and are not a recommendation to buy or sell any securities.

This article may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although Verger believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed. Except where otherwise indicated, all of the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor's fees or other trading expenses.