Waiting...

“Nothing happens, nobody comes, nobody goes, it’s awful.”

Estragon, one of two main characters in Samuel Beckett’s tragicomedy, “Waiting for Godot,” utters the phrase above as he and his companion Vladimir wait on the arrival of the eponymous Godot. Estragon's statement reflects the sense of uncertainty, frustration, and even meaninglessness he and Vladimir experience as they pass the time waiting for Godot, who, as those familiar with the play may already know, never arrives.

A similar feeling of uncertainty and, perhaps, impending doom, faces investors as they endure the impulsive, verbose, and sometimes absurd proclamations of TV pundits and market prognosticators. The future is always uncertain – what is certain is the irrationality and unpredictability of the market and the futility of trying to forecast short-term expectations. So whether we’re waiting for the Fed, a recession, or even the next bank collapse, the focus should always remain on the long-term.

Market Review

Two major themes in the 1st quarter should seem familiar, as they have been almost constant topics of conversation for investors over the past two years – inflation and interest rates. While data indicates significant cooling, inflation is still above the average of the past two decades and the Fed’s long-term target rate of 2%. March’s inflation report came in at 4.98%, significantly lower than last March’s 8.54% and last June’s peak of 9.06%. Regardless, inflation continues to take a toll on consumers as salaries and wages struggle to keep up with the increasing price of goods & services. In an effort to combat inflation, the Fed has moved forcefully over the past year, raising the federal funds rate by 5% since March of 2022, including two moves of 25 bps in the 1st quarter.

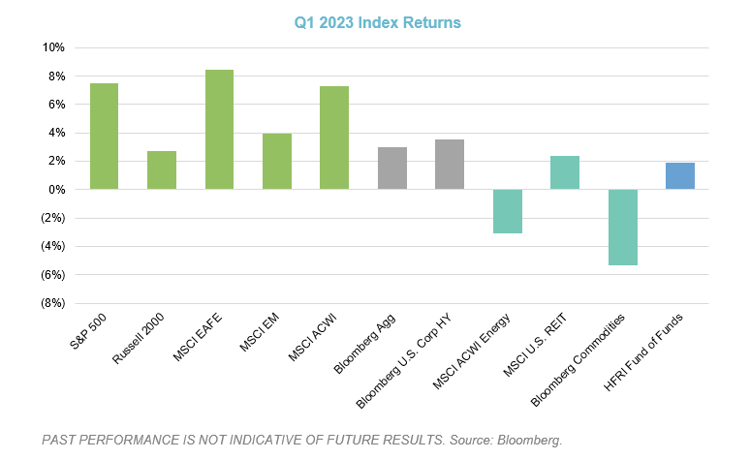

In spite of these continued increases, investors are optimistic that future rate hikes will be limited and that we may be at the end of the rate hike cycle, which has proved to be a powerful market stimulus in the 1st quarter, as both equities and fixed income performed well through March with global equities up over 7% and core bonds up nearly 3% (as measured by MSCI ACWI, global equities, and the Bloomberg Aggregate, fixed income). Despite this optimism, there remains doubt regarding the long-term growth prospects of the economy. Slowing growth could potentially impact the demand for energy and other commodities, which resulted in price declines for these sectors as investors weighed future demand for travel, construction, shipping, and raw materials.

While falling inflation and rising rates proved a tailwind for some areas of the market, one of the big stories of the quarter was partially a result of rising rates – the collapse of three banks over the course of five days. While the drivers of Silvergate, Signature Bank, and Silicon Valley Bank’s failures were numerous (including poor risk management and exposure to volatile assets like cryptocurrency and venture capital), it’s clear that losses on the bank’s reserve portfolios resulting from a rising rate environment were partially at fault. Many national and regional banks are scheduled to report earnings over the next few weeks, so we will soon have a better idea of the impact of these bank failures and the interest rate environment have on the overall industry. What’s clear is that rising rates have had a significant impact on the banking sector as a whole, but each institution has fared differently dependent on how they have mitigated that impact.

Outlook and Opportunities

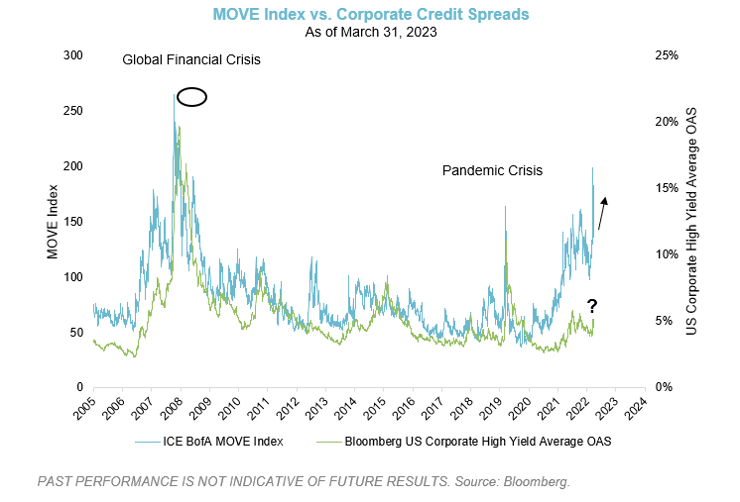

The rising rate environment and continued concerns regarding the stability of financial institutions may also have greater implications for bond investors going forward. Interest rate volatility (as measured by the MOVE Index) has increased steadily over the past few years, and this increase has typically resulted in widening corporate credit spreads, evident during the Great Financial Crisis of ’08 – ’09 and in the wake of COVID’s initial outbreak in ’20. However, the most recent increases in interest rate volatility have not triggered a corresponding increase in credit spreads. Thus, our view is that investors should generally be wary of lower credit quality bonds given the current lack of any significant risk premium.

While we see limited opportunity in credit spread products today, we are more optimistic about the current environment for certain closed-end funds. As our clients and frequent readers of our commentary may remember, we previously invested with a manager at the outset of the COVID pandemic to take advantage of historic spreads between the trading price and NAV of some specific closed-end funds. That spread closed quickly and we were able to monetize our investment within only a few months. As a result of the recent turmoil in the credit markets, we are experiencing another attractive entry point for certain closed-end funds with an opportunity for idiosyncratic returns uncorrelated to the larger credit markets.

Another area where we see opportunity going forward is in self-storage, a subsector of the commercial real estate market. While that may seem counterintuitive given our previous concerns regarding interest rates and the potential for slowing growth, we believe the self-storage subsector has attractive long-term fundamentals. Self-storage has historically proven resilient across economic cycles due to monthly leases, and demand generally driven by life events uncorrelated with the broader economy. Other drivers of this sector include the fact that the millennial generation is the largest user of self-storage, and it is an industry characterized by high margins, stable cash flows, and low capital expenditures.

Closing Thoughts

Among the many themes of “Waiting for Godot” is a focus on the futility of life. Estragon and Vladimir spend their time waiting for someone who never arrives, wasting away their time as they search for meaning while subject to forces which they can’t control. As investors, we should naturally feel a sense of camaraderie with these two – struggling with the uncertainty and confusion of what’s to come, searching in vain for a sign of what, if anything, to do next. Estragon recognized the futility of his situation and, as a result, his solution was simple – “Don’t let’s do anything. It’s safer.” Unfortunately, investors can’t follow suit because doing nothing is often not the safer option. We can’t be complacent in the face of changing conditions, but we need to avoid the futility of believing that we can predict what’s going to happen this week, this month, or even this year. Rather, we must prepare ourselves by building a portfolio that can perform in (or endure) any predicament that the market presents us. That’s why Verger focuses on building all-weather, antifragile portfolios that can perform across all markets.

Critic Vivian Mercier described Waiting for Godot as a play which "has achieved a theoretical impossibility – a play in which nothing happens, that yet keeps audiences glued to their seats.” While it is rare that “nothing happens” in the markets, it is certainly true that it keeps its audience, investors like ourselves, glued to our seats (and our TVs, and our phones, and our computers…).

Verger’s quarterly investment webinar covers market review and outlook in more depth and is open to qualified investors. To request an invitation to the next webinar to be held on May 4th at 1 pm ET, please contact us using the form found here.

All investments involve risk, including possible loss of principal.

Not all strategies are appropriate for all investors. There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives. Diversification does not ensure a profit or protect against a loss.

One cannot invest directly in an index, and unmanaged indices do not incur fees and expenses.

This article is being provided for informational purposes only and constitutes neither an offer to sell nor a solicitation of an offer to buy securities. Offerings of securities are only made by delivery of the prospectus or confidential offering materials of the relevant fund or pool, which describe certain risks related to an investment in the securities and which qualify in their entirety the information set forth herein. Statements made herein may be materially different from those in the prospectus or confidential offering materials of a fund or pool.

This article is not investment or tax advice and should not be relied on as such. Verger Capital Management (“Verger”) specifically disclaims any duty to update this article. Opinions expressed herein are those of Verger and are not a recommendation to buy or sell any securities.

This article may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although Verger believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed. Except where otherwise indicated, all of the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor's fees or other trading expenses.