2022 Fiscal Year: A Tale of Two Halves

Unpredictable Markets & Predictable Investor Reactions

Panic. Surrender. Capitulation. Mania. Call it what you will, but what we saw in the first six months of this year was the worst start to a calendar year for equities (as measured by the S&P 500) since 1970 (52 years!) (Source: Bloomberg). While markets can be unpredictable, this could be expected given what has happened recently in the global economy. Central banks printing money leads to inflation. COVID shutdowns and a war in Europe cause debilitating supply chain issues that disrupt a wide spectrum of industries. The writing has been on the wall for some time, but investors are just starting to accept the consequences and their reactions have been predictably severe across most markets.

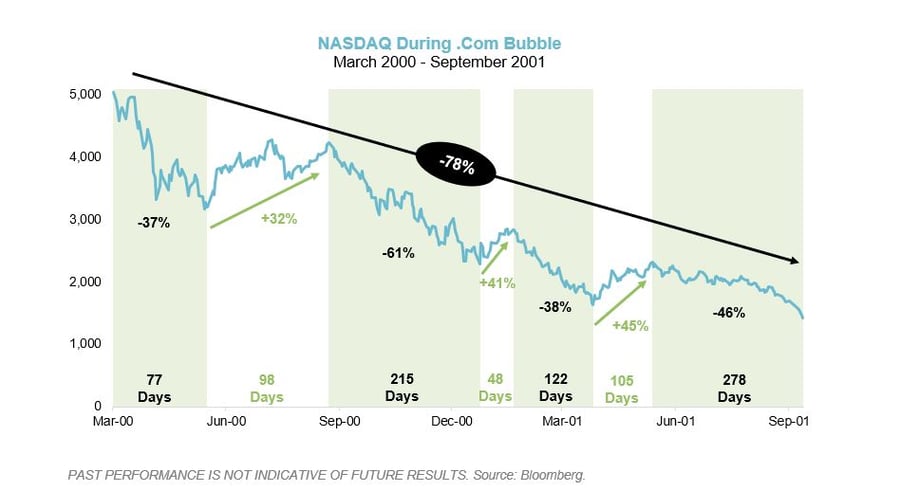

It’s been a long time since we had a real panic sell-off like we’ve seen year to date, so it may be hard to explain that this is not an unprecedented anomaly or a tail risk event. Rather, it is well within the bounds of typical market volatility. However, on the heels of a 10-plus year bull run that was capped off by a top quartile second half of 2021, the 2nd quarter’s correction appears even more jarring (Source: Bloomberg). When viewed through the lens of the fiscal year ending June 30th, it really has been the tale of two halves, or a case of Dr. Jekyll & Mr. Hyde.

Most of what we have seen across the markets this quarter can only be viewed as reactionary, as many investors furiously tried to reposition their portfolios. This follows a period of irrational exuberance where a lack of discipline and chasing of returns was fueled by cheap capital and the ever-present fear of missing out (FOMO). At Verger, we continue to embrace a disciplined process that is proactive rather than reactive. We believe our portfolio is not only well positioned for the recent volatility but to also take advantage of opportunities it uncovered.

Market Review: A Sea of Red

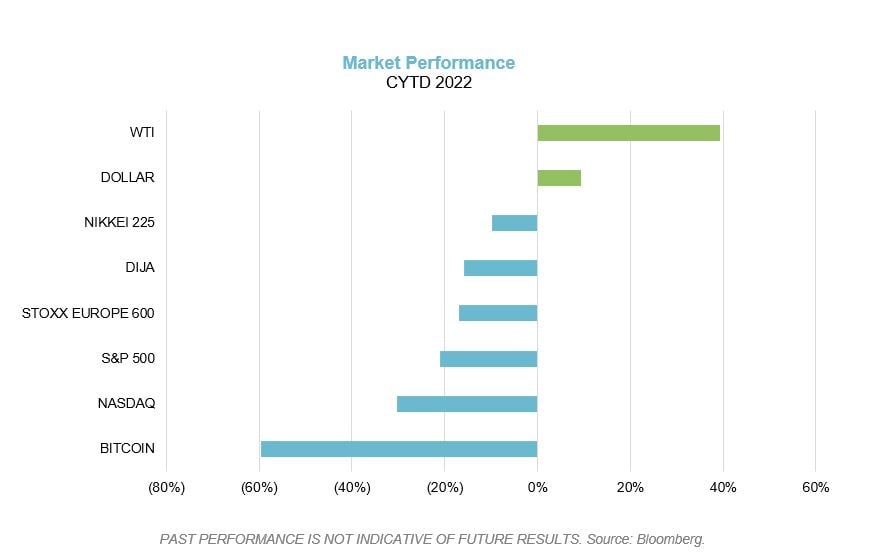

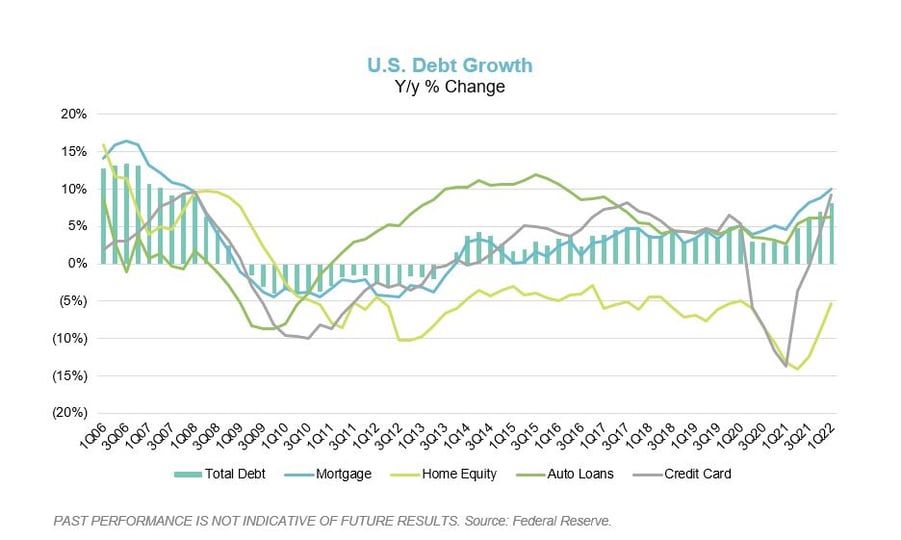

Regardless of asset allocation and exposures, most institutional investor portfolios saw significant downside pressure in the 2nd quarter. Our Q1 commentary highlighted the impact of the Russian invasion of Ukraine and the myriad of factors that were creating a growing inflationary market. Unfortunately, both scenarios remained present in Q2 which fueled significant downside volatility across most markets as consumers faced persistent inflation (CPI of 9.1% in June) and record high gasoline prices (Source: U.S. Bureau of Labor Statistics). Declining earnings forecasts and uncertain growth prospects added fuel to the fire as lower wage growth, higher cost of capital (particularly mortgages), and shrinking government support mean less discretionary income for consumers and a return to the pre-pandemic reliance on debt to maintain their lifestyle.

We have begun to see cracks in the job market, with layoffs and rescinded job offers in certain industries. This has led to a decline in consumer sentiment over employment fears and concerns regarding whether wages can grow at the same pace as inflation. Add in a hawkish Fed that raised rates by 50 bps in May and another 75 bps in June, and there is valid concern that the post-pandemic recovery may be short-lived and overbought.

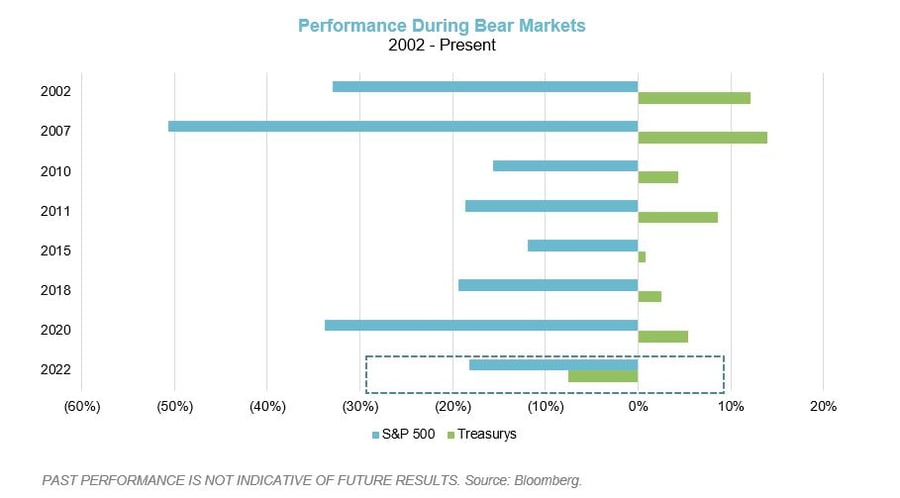

Given the abundance of negative indicators, it is no surprise that much of the equity market has sold off, but historically, this has been the type of environment when bonds have provided some ballast to investor portfolios. Unfortunately, bonds have provided little cushion this year as spreads have widened on the heels of the worst 1st quarter since 1976.

There have been a few bright spots amid the chaos. Despite a late sell-off in Q2, the energy markets have been strong this year, with both the S&P 500 Energy Index and MSCI World Energy Index up over 24% YTD (Source: S&P Global and MSCI). Additionally, certain absolute return and long/short strategies have performed as advertised, but the spread in performance across managers has been large. Anecdotally, the dichotomy in performance is evident between those who are truly hedged vs. those who are not (net long funds, hybrid private/public equities funds, etc.).

One area to keep an eye on is the private markets. So far, the impact on valuations year to date has been minimal, but changes in private asset valuations generally lag large moves in the public markets. Deal dynamics have already begun to change, and we believe a shakeout may occur as reduced access to capital leads to smaller deal sizes and lower valuations. As one seed-stage VC investor commented, “never has [sic] previous round valuations felt more stale and inconsistent with the current market” (Source: Eric Paley, Co-founding partner at Founder Collective, via Twitter). We expect some markdowns in the private markets, the magnitude of which remains to be seen. We believe less disciplined investors will see the value of their investments fall to a greater extent as liquidity has dried up and outsized valuations can no longer be supported. Additionally, exit opportunities have decreased, particularly through the public markets as IPO activity has fallen off a cliff this year. Our team at Verger continues to remain disciplined, investing consistently across vintage years and asset classes for our private portfolio rather than chasing returns in a hot market. Though our portfolio is not immune to market moves, we invest in managers who are disciplined about sizing their investments and the pace at which they deploy capital as the market environment shifts. We believe our steady investment process will mitigate our portfolio against short-term disruptions in the capital markets.

Market Outlook: The Fed Wildcard

While it is not certain that a recession is imminent, there are signals that the economy is headed in that direction. Asset prices have come down and earnings expectations could follow. Inflation is high and economic growth is slowing, which could result in stagflation. The Fed has signaled a hawkish stance, and even Chairman Powell has hinted that Fed actions could contribute to a recession, saying, “It's not our intended outcome at all but it's certainly a possibility.”[1] Additionally, it is worth noting that 11 of the last 17 bear markets did not begin their recovery until after the Fed began signaling a loosening of monetary policy, so future hikes do not bode well for the markets. While every indication is that the Fed will maintain its current path in seeking the goal of price stability, there remains the potential for Fed capitulation should its actions prove too damaging to the capital markets.

So, while Fed decision-making is a wildcard, many other factors have the potential to draw us into a recession. It appears more and more likely that economic growth and earnings growth will be lower in the 2nd half of the year. Consumer sentiment is at its lowest level since it began being measured 70 years ago[2] and discretionary spending is likely to decline as wage growth struggles to keep pace with the increasing the price of goods and higher mortgage and rent payments.

Given widespread recession expectations, our focus is on opportunities which are either recession resistant or attractive due to a valuation reset. It is also important to be cognizant of bear market rallies, a common phenomenon that may falsely signal a course correction. Buy the dip may not be dead, but proceed with caution!

Market Opportunities: Long Hard Assets & Value, Short Zombies

The opportunity set looks dramatically different than it did 12 months ago when generationally low interest rates and strong investor optimism created a “risk on” environment for much of the market. Fast forward to today and there has been a 180-degree rotation into “risk off” strategies as investors seek to shore up their portfolios and protect against further loss after six months of downside volatility. While we have not been immune to market declines this year at Verger, our portfolio is well-positioned to protect against the most dramatic losses and allow us to take advantage of new opportunities available today. So, what is the plan looking forward?

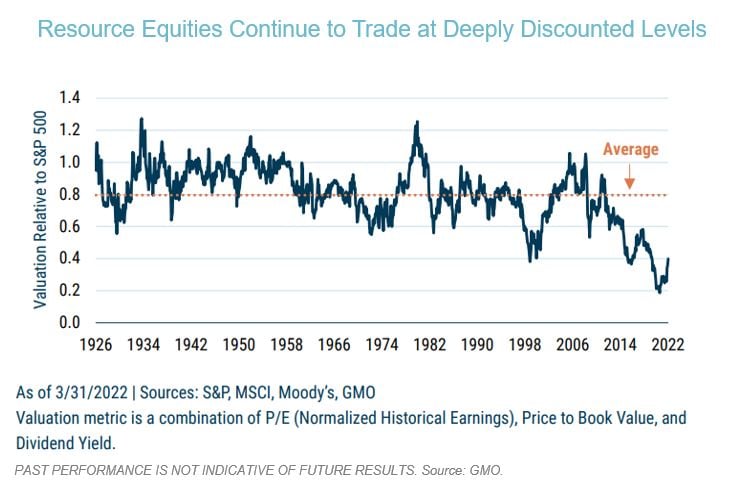

First, we continue to believe commodities, and particularly energy, remain attractive and trade at a discount compared to other sectors. As we have received distributions from our current investments in this sector, we have reinvested a portion of the proceeds while allocating to alternative sectors, as well.

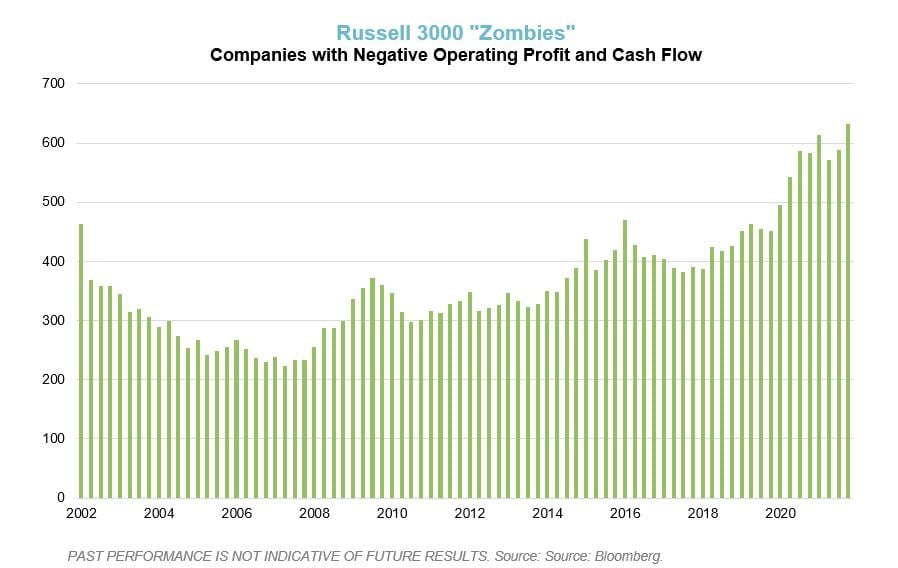

One area that held up better than the overall market during the first half of the year, and continues to look favorable, is the long/short segment. We work with a variety of long/short managers and believe that the shorting environment today is even more attractive than it was six months ago. This is particularly true of highly levered companies that have a high cash burn rate, many of which are so-called “zombies,” firms that are unable to generate enough profits to cover debt-servicing costs and that need to borrow to stay alive. As one manager stated to us, they believe that many of these businesses, some which are down over 50% already, are even better shorts today than they were a few months ago. The probability of these businesses failing has increased substantially now that there is less readily available cash for them to sustain their operations.

Additionally, the recent rise in interest rates, coupled with elevated market volatility has negatively impacted many emerging market (EM) countries. In addition to falling equity prices and rising bond yields, many EM currencies have also declined, in some cases quite significantly. Our managers continue to seek out targeted opportunities within EM where they believe markets may have overreacted and the baby has been thrown out with the bathwater.

Concluding Thoughts: The Reckoning

Reckoning (noun) - the avenging or punishing of past mistakes or misdeeds

In the 1993 movie Tombstone, Val Kilmer’s character, Doc Holliday, says of Kurt Russell’s Wyatt Earp, “It's not revenge he's after, it's the reckoning.” At risk of sounding overly dramatic, it seems that a reckoning has occurred in the financial markets. It’s clear that prior to this year, there were many mistakes and misdeeds that had gone unpunished. Cheap capital and government subsidization of consumers and companies had grossly inflated the economy and company valuations. We were living a bit of a fairytale where most financial assets were priced to perfection and future growth (and performance) expectations were wildly unrealistic. This finally started to unravel at the beginning of the year and came to a head during Q2.

Looking ahead, institutional investors should lean heavily on proper governance and focus on their fiduciary duty to their constituents. At Verger, we believe managing risk will be imperative as investors seek to protect against further pain while also ensuring future growth. This means continuing to find opportunistic investments while maintaining a portfolio of strategies that diversifies return streams and sources of risk. The goal is to mitigate the downside risk while capturing as much upside as possible in a market that may deliver more muted returns going forward in comparison to the last several years. The financial markets tend to reset from time to time, but predicting the exact timing or magnitude is difficult. Thus, it is better to be positioned appropriately at all times, ready to absorb the bad, profit from the good, and take advantage of opportunities that emerge, even in a time of reckoning.

Verger’s quarterly investment webinar covers market review and outlook in more depth and is open to qualified investors. To request an invitation to the next webinar, please contact us using the form found here.

[1] Source: https://www.npr.org/2022/06/22/1106735608/powell-says-recession-a-possibility-but-not-likely

[2] Source: New York Times, May 6, 2022, “In June, the University of Michigan’s survey of consumer sentiment hit its lowest level in its 70-year history, with nearly half of respondents saying inflation is eroding their standard of living.”

All investments involve risk, including possible loss of principal.

Not all strategies are appropriate for all investors. There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives. Diversification does not ensure a profit or protect against a loss.

One cannot invest directly in an index, and unmanaged indices do not incur fees and expenses.

This article is being provided for informational purposes only and constitutes neither an offer to sell nor a solicitation of an offer to buy securities. Offerings of securities are only made by delivery of the prospectus or confidential offering materials of the relevant fund or pool, which describe certain risks related to an investment in the securities and which qualify in their entirety the information set forth herein. Statements made herein may be materially different from those in the prospectus or confidential offering materials of a fund or pool.

This article is not investment or tax advice and should not be relied on as such. Verger Capital Management (“Verger”) specifically disclaims any duty to update this article. Opinions expressed herein are those of Verger and are not a recommendation to buy or sell any securities.

This article may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although Verger believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed. Except where otherwise indicated, all of the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor's fees or other trading expenses.