The Fight Ahead

“The hero and the coward both feel the same thing. But the hero uses his fear, projects it onto his opponent, while the coward runs. It’s the same thing, fear, but it’s what you do with it that matters.” - Cus D’amato

Sporting analogies often provide some interesting parallels to the world of finance. In reviewing the 1st quarter of 2022, the idea of the boxer on the ropes certainly springs to mind when thinking about the market’s woeful performance over the first two months and strong comeback in March. Equities and bonds took punch after punch, and it appears global equities have picked themselves off the mat while bonds are still face down on the floor. The fears of a recession, a world war, and a Fed misstep are still there, but as a long-term investor, what is most important is that we remain prepared to stay in the fight for the many rounds ahead.

Even in the face of a March rebound, investors today are still fighting significant headwinds, and it seems like the situation has only intensified over the past three months. We have seen increased market volatility, significant inflation, and the first of what will likely be several interest rate hikes by the Fed. These factors alone are daunting, but when combined with the continued global impacts of COVID and the war in Ukraine, the environment for investors is fraught with difficulty.

Market Review & Outlook: Volatility is Here to Stay

Any discussion of the market over the past quarter would be incomplete without discussing the Russian invasion of Ukraine. The resulting sell-off and volatility added to the rough seas the market was already experiencing in January and February. The conflict’s impact has been far-reaching as humanitarian issues have arisen in Ukraine, Russia, and Europe. Global markets are suffering from uncertainty and instability, and there is growing concern that commodity and food shortages could spread, creating even greater humanitarian concerns and global economic strife.

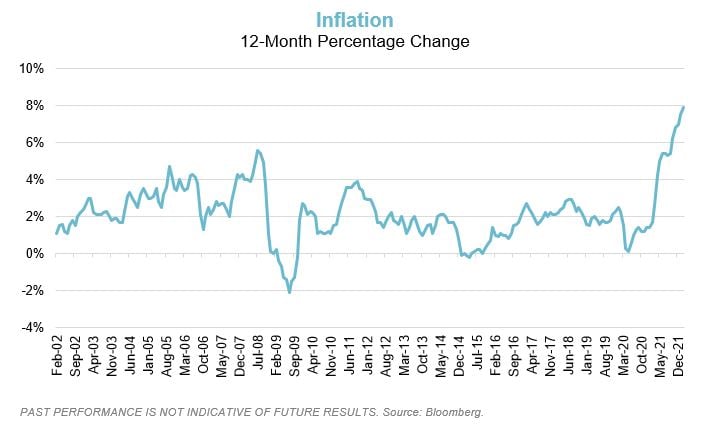

Along with these geopolitical issues, the economy continues to experience inflationary pressures, particularly here in the United States, as continued supply chain disruptions and increased consumer demand resulted in prices 7.9% higher in February compared to the prior year. This is the largest annualized growth in CPI inflation since 1982 and is driven largely by consumer staples like food, energy, and shelter (source: Forbes). When paired with the Fed’s 25 basis point rate increase in March, rising inflation has created greater uncertainty about the rate of future economic growth. This concern is exacerbated by reduced government stimulus compared to what took place at the onset of the pandemic. This creates a volatile environment where markets may not rebound as quickly as they did during more recent sell-offs.

Year to date, this volatility has resulted in global equity markets, as measured by MSCI ACWI, being down 5.36%, with international and emerging markets the greatest detractors. US equities have held up slightly better with the S&P 500 down 4.10% (Source: Bloomberg, through 03/31/2022). However, this masks some of the turmoil and volatility we have seen in certain sectors, particularly the high-flying tech and growth stocks (many of them unprofitable) that were the cause célèbre of the market over the past few years. Furthermore, as rates have risen and fears of non-transitory inflation rise, the fixed income market has suffered as well. Through the end of March, the Bloomberg Barclay’s Aggregate is down 5.93%2 year to date, which means US bonds are well on pace for their worst year ever – the record is -2.9% in 1994 (source: Bloomberg).

One of the few bright spots this quarter was the commodities market, as prices continued to increase due to greater demand paired with supply chain issues caused by COVID and the war in Ukraine. Commodities, along with certain absolute return strategies, proved to be the best diversifiers during a period that saw strong correlation and negative returns across traditional equity and fixed income strategies.

While the private markets have been additive over the past few years, there are valid near-term concerns about the ongoing viability of SPAC or IPO exits for venture and private equity as the level of readily accessible liquidity and inexpensive capital has started to wane. At this point last year, 79 companies had gone public via traditional IPOs representing $36 billion in market capitalization – over the same period this year only 22 companies have followed suit representing $2.3 billion in total (Source: www.shortsqueez.co newsletter). While we continue to see a positive illiquidity premium in the private markets and believe that the long-term prospects are positive, we remain diligent in rightsizing both our future commitments and the overall allocation to illiquid assets in the portfolio.

Given the current environment, it’s only natural to question the resiliency of the market going forward and evaluate what options are available for long-term investors. As market momentum has all but evaporated over the past quarter, and there is less confidence that the Fed will step in with stimulus, we anticipate returns going forward could be lower. This does not necessarily mean a repeat of the past quarter where we saw markets retreat, but it could mean a sustained period of lower returns. Given this potential scenario, Verger’s view is the need for discipline and diversification has never been greater as investors try to separate the wheat from the chaff.

One factor that has been at the forefront of conversations is inflation. At this point, we feel that it is safe to say that the current inflationary trends are by no means transitory. However, there is debate about where the rate of inflation will start to level out. Historically, moderate inflation of around 2% to 3% results in strong real returns, but once inflation creeps above that level, it negatively impacts long-term growth and returns. Thus, investors must keep a close eye on the level of inflation to help determine their strategy for equity allocations. Additionally, the current level of inflation likely means the outlook for traditional fixed income strategies is fairly bleak as the increasing cost of goods and services outpaces interest rates by a wide margin.

Overall, it seems that many investors are taking a wait-and-see approach toward a market that provides less support for risk-taking behavior than in the prior 12 to 24 months. While this approach may be prudent for some, it is important to acknowledge that the road ahead is fraught with obstacles unless your portfolio is well-diversified with multiple, uncorrelated sources for return. Assuming investors do not already have an all-weather, antifragile portfolio in place, the short-term outlook may leave some paralyzed with indecision in the face of a market that provides very little positive signaling for traditional equity and fixed income.

Market Opportunities: Quality on Sale

We view things differently at Verger and believe that opportunity exists in every market – sometimes, it’s just harder to find. Thus, we believe it is more critical than ever for investors to look outside the box for opportunities that are less correlated to the broader markets and have the potential to provide returns across a wide range of scenarios. That said, even today, we see examples of good long-term investment opportunities within the traditional equity markets.

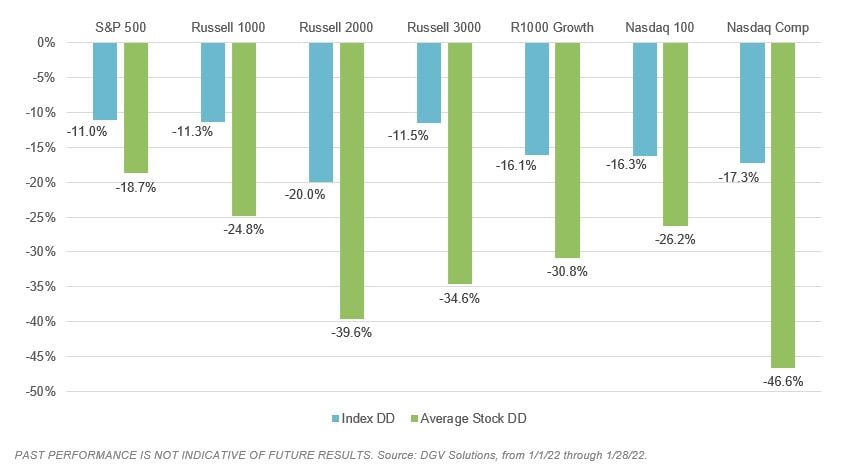

We believe the recent equity volatility lends itself well to disciplined, active managers on the hunt for quality businesses at a discount. In other words, sell-offs like we saw in the first quarter lead to the carnage in the equity markets that can also present opportunity. What is unique about this past quarter is that the price decline within many of the equity indices was asymmetric – while the major US indices were down anywhere from 11% to 20% in the first few weeks of January, the average individual stock within each index was down significantly more:

Thus, certain companies or sectors saw larger price declines than the overall indices, and we believe this presents a tremendous opportunity. In digging deeper, we found that some of the largest declines occurred in historically expensive, high-quality software and technology companies that were suddenly trading at a significant discount. This allows investors to capture the future growth of these companies at a significantly discounted price to earnings multiple as compared to what was available only weeks ago. Several managers within the Verger portfolio have pursued this strategy on our clients’ behalf, which we believe makes them well-positioned to benefit from the price recovery of these quality businesses.

An OCIO Perspective: What (Not) To Do?

Our view is that volatility always provides opportunity; it just takes skill to capture it. Unfortunately, the source of that volatility may present questions regarding how to best manage our clients’ capital and do so in good conscience. As the humanitarian tragedy of Russia’s invasion of Ukraine continues to unfold, it’s important to note that our clients’ exposure to Russia has historically been minimal and today stands at less than 0.1% of the portfolio. We have no plans of adding exposure to Russia in the foreseeable future. Additionally, this presents a good opportunity to reaffirm what we will and won’t do on behalf of our clients:

- We WILL continue to seek out unique opportunities, some of which will naturally arise from the continued volatility created not only by the war in Ukraine but also by additional geopolitical tensions, the continued impact of COVID, inflationary concerns and supply chain issues.

- We WILL continue to delineate between investing and speculating, which means pursuing opportunities with a true, long-term investment thesis instead of speculating on opportunities with too many uncertain variables.

- We WILL NOT change our overarching philosophy of building a diversified and opportunistic portfolio of top-tier managers executing their best ideas.

World-renowned boxing trainer Cus D’amato was famous for his fighting style – gloves up, near the chin to protect the head, and arms tucked close to the body to deflect body blows. But the most important element of his style was that by absorbing and overcoming your opponent’s punches, you were better prepared to go on the offensive when your opponent had weakened and was more vulnerable. The 1st quarter of 2022 was another reminder that thriving in turbulent markets is an exercise in agility and being prepared to take a punch. We were able to deflect most of the punches the market delivered and took advantage of the opportunities that surfaced last quarter. Going forward, we endeavor to continue participating while protecting as we attempt to both capture upside and eliminate as much downside as possible.

At Verger, we make important decisions every day serving as fiduciaries on behalf of our clients. We recognize, however, that our day-to-day responsibilities pale in comparison to the struggle of those worldwide dealing with the impact of war and disaster like the people of Ukraine. Our thoughts are with them and all of those impacted by global turmoil and conflict.

Verger’s quarterly investment webinar covers market review and outlook in more depth and is open to qualified investors. To request an invitation to the next webinar in May 2022, please contact us using the form found here.

All investments involve risk, including possible loss of principal.

Not all strategies are appropriate for all investors. There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives. Diversification does not ensure a profit or protect against a loss.

One cannot invest directly in an index, and unmanaged indices do not incur fees and expenses.

This article is being provided for informational purposes only and constitutes neither an offer to sell nor a solicitation of an offer to buy securities. Offerings of securities are only made by delivery of the prospectus or confidential offering materials of the relevant fund or pool, which describe certain risks related to an investment in the securities and which qualify in their entirety the information set forth herein. Statements made herein may be materially different from those in the prospectus or confidential offering materials of a fund or pool.

This article is not investment or tax advice and should not be relied on as such. Verger Capital Management (“Verger”) specifically disclaims any duty to update this article. Opinions expressed herein are those of Verger and are not a recommendation to buy or sell any securities.

This article may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although Verger believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed. Except where otherwise indicated, all of the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor's fees or other trading expenses.