What’s IN and What’s OUT for 2025

|

In:

|

Out:

|

Every January, social media feeds and lifestyle magazines overflow with "What's In/What's Out" lists. From fashion trends to food fads, these annual proclamations attempt to capture the zeitgeist of the moment while making bold predictions about the year ahead. While these lists can be entertaining, they often prove as fleeting as most New Year's resolutions – what's “in” today can be decidedly “out” by spring.

In the investment world, we at Verger see similar patterns of rapidly shifting sentiments and predictions. Take, for example, the dramatic swing in market outlooks following November's election results, or the reactive shifts in consensus around the Federal Reserve's interest rate decisions. Just as fashion influencers confidently declare the death of skinny jeans one season only to herald their inevitable comeback the next, market commentators can pivot from bearish to bullish perspectives with remarkable speed and breathless conviction.

At Verger, we believe the most reliable approach isn't about chasing the trends or making bold proclamations about what's definitively in or out. Instead, we focus on maintaining a disciplined, antifragile investment strategy that can withstand changing market conditions and evolving investor sentiments. Nevertheless, as we enter 2025, we thought it might be enlightening (and perhaps a bit entertaining) to frame our market outlook through the lens of topics that deserve more emphasis in the world of non-profit investment management and those that might be better de-emphasized.

Like any good In/Out list, ours isn't meant to be definitive or permanent. Rather, it reflects our current thinking about forward looking market opportunities and risks, always with an eye toward our enduring aim to Protect, Perform, and Provide for our non-profit clients.

Market Review

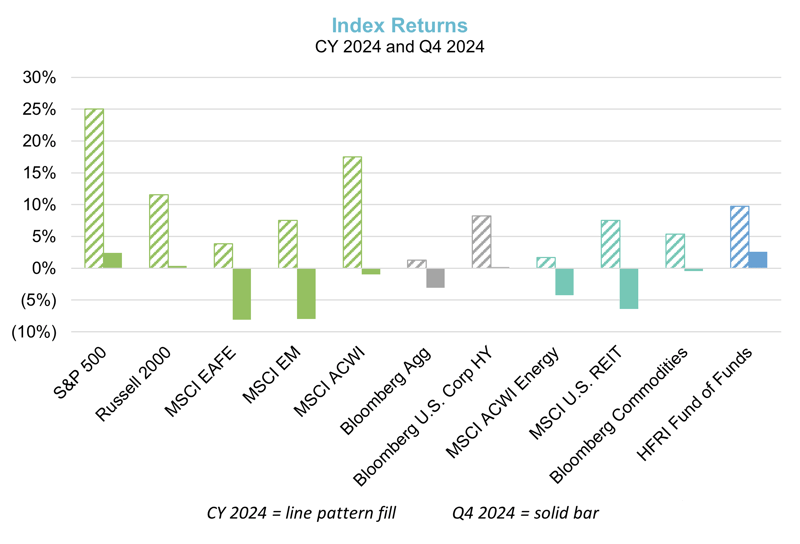

A Republican sweep in the election (President, Senate, and House) led to a strong equity rally in November, with the S&P 500 gaining 5.9% for the month and most of the gain coming in the week of the election. While the months of October and December saw declines, the S&P 500 finished with a +2.4% return for the quarter. Due in part to an “America first” agenda from the incoming administration, which includes the threat of tariffs, international equities declined during the quarter, as represented by the MSCI EAFE at -8.1%. Tariffs were certainly a popular topic as the year ended, with the Washington Post’s In/Out list declaring “misunderstanding tariffs” were out while “$20 avocados” were in.

Looking at the U.S. bond market for the quarter, historically unusual results may have caught some investors by surprise. From the beginning of the Fed easing cycle in September, when rates were eased by a total of 100 basis points, investors saw the 10 year Treasury yield rise (not fall) by 95 basis points. This is a good example of how difficult it can be to predict the (bond) markets. Through year end, the U.S. investment grade bond market has now been in a drawdown for 53 months – by far the longest on record, based on monthly data going back to 1976.

At a high level, 2024 produced similar return patterns as 2023. For the year U.S. stocks outperformed the rest of the world and, within the U.S., growth trounced value and large cap beat small cap. The S&P 500 returned +25.0%, with growth stocks outperforming value stocks by more than 23 percentage points (36.1% vs. 12.3%). While positive, international equities dramatically underperformed the U.S. (with MSCI EAFE +3.8% and MSCI Emerging Markets +7.5%).

At an even higher level – we’ll note that, over the last two years, large growth stocks have outperformed large value stocks by the widest margin ever (based on data going back to 1979).

Source: Bloomberg

Market Outlook

In thinking forward to 2025, we at Verger are not in the business of making the kind of bold proclamations or speculative predictions that drive typical In/Out lists. Instead, we remain grounded in our all-weather philosophy and our nuanced approach to asset allocation – and committed to identifying high conviction ideas that reflect evolving conditions.

Our version of the classic In/Out list below highlights things we’d like to see more of, emphasize, or overweight, as well as the opposite – things to do less of, de-emphasize, or underweight.

In: Absolute return and risk

Out: Relative return and risk

As we’ve pointed out in recent market commentaries, we continue to see some potential signs of market excess, such as high U.S. equity valuations, extreme market concentration, and very tight corporate credit spreads. To add to the list, particular cryptocurrencies such as Peanut the Squirrel, ApeCoin, and F*rtCoin have reached market caps around $1 billion. Especially in this environment, we feel it is imperative for non-profits to remain focused on their primary objective of supporting their mission over a long-term horizon. While there can often be other objectives (e.g., performance vs. a benchmark, or performance vs. peer institutions), the key for most non-profit institutions is to generate a return that, over time, equals their spending rate plus inflation. We at Verger feel that shorter term results vs. a benchmark (in other words, relative returns) should not be the primary focus – especially not in 2025.

In: Global equity diversification

Out: Concentrated U.S. equity exposure

The Verger team continues to believe that geographic diversification within an equity allocation is prudent and appropriate, and that there are attractive opportunities for long-term investors investing abroad. Per the first chart below, U.S. equities have generally outperformed since the Global Financial Crisis and now represent ~ 67% of global equity indices – this is more than 10x the next biggest individual country, which is Japan at ~ 5% weight. Some of the recent U.S. outperformance has been due to rising valuations, with the U.S. market now currently trading at much higher valuation ratios than other regions (see the second chart below). As illustrated in the third chart below, at these valuation levels, longer term prospective U.S equity returns may be quite low, if historical patterns continue to repeat themselves.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Source: VCF Investment Manager

*Dots represent monthly data points since 1988. Source: J.P. Morgan Asset Management

In: Nuanced asset allocations… beyond stocks and bonds

Out: Rigid 60/40 stock and bond portfolio allocation

Given relatively high U.S. equity valuations as well as uncertainty regarding inflation and the related impact on bond prices, we continue to believe that asset segments such as real assets and uncorrelated hedged investments can serve as strong portfolio diversifiers. It wasn’t that long ago (calendar year 2022) when both stocks (MSCI ACWI at -18%) and bonds (Bloomberg U.S. Aggregate at -13%) experienced double-digit declines.

In: Fixed Income opportunities related to mortgages and emerging markets debt

Out: U.S. Corporate credit

Within the Fixed income asset class, corporate credit spreads (both Investment grade and high yield) are near all-time tight levels (see the chart below). We believe there will be better entry points for corporate credit in the future. Instead, we currently see more attractive opportunities in both mortgages and emerging market debt. Mortgage spreads are at much more attractive (i.e., wider) levels than corporate credit. In emerging markets, there tends to be less competition (markets are more inefficient) and there is greater ability for our managers to “influence the outcome” (e.g., restructurings).

Source: Bloomberg, J.P. Morgan Asset Management

Taken together, the items on our In/Out list underscore our view that now, as ever, it is important to be prepared for bouts of volatility and strong market reactions to surprise events. At Verger, we seek to diversify our risk exposures across and within asset classes and focus on the underlying and evolving causes of risk rather than traditional asset class labels and historical returns.

Market Opportunities

To illustrate the idea of diversifying equity allocations based on underlying risk and return exposures, we will highlight our current interest in one sector. As highlighted above (and in previous commentaries), the current environment where broad U.S. equity market valuations are already quite elevated is a tough place to bet on further multiple expansion. Instead, we feel that strategies emphasizing shareholder yield can be an attractive alternative. One such sector is energy. Per the chart below, when combining dividends and net buybacks, energy currently (as of January 2025) has the highest total shareholder yield.

Source: J.P. Morgan Asset Management

Many energy companies, based in part on pressure from shareholders, have been willing to embrace a new playbook that emphasizes reinvesting profits in new development projects that make economic sense, returning cash to shareholders through sustainable dividends, and focusing on growing scale through consolidation, which can allow for further cost reductions, with savings flowing to investors.

We will continue to search for this kind of opportunity that allows us to further diversify the sources of our returns.

Closing Thoughts

Given the popularity of In/Out lists at the start of a new year, there’s always the chance that they all start to sound the same. Markets are no different – and it’s common for pundits and research houses to become echo chambers of the same, short-term focused forecasts. In some cases, however, In/Out lists are refreshing and interconnected: take, for example, Vogue declaring the In/Out list format OUT for 2025 and Glamour declaring “contrarianism” in.

At Verger, we search for pieces of information that are similarly interesting and interconnected. What we hope to find will support longer-term views across market cycles or illuminate key drivers of risk and return. As always, we are focused on disciplined analysis and a consistent, repeatable investment process rather than the latest popular trends and market fads. As we move into 2025, we remain committed to our antifragile, all-weather investment philosophy and confident in our consistent ability to Protect, Perform, and Provide across all market environments.

All investments involve risk, including possible loss of principal.

Not all strategies are appropriate for all investors. There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives. Diversification does not ensure a profit or protect against a loss.

One cannot invest directly in an index, and unmanaged indices do not incur fees and expenses.

This article is being provided for informational purposes only and constitutes neither an offer to sell nor a solicitation of an offer to buy securities or otherwise engage Verger Capital Management for investment advisory services. Offerings of securities are only made by delivery of the prospectus or confidential offering materials of the relevant fund or pool, which describe certain risks related to an investment in the securities and which qualify in their entirety the information set forth herein. Statements made herein may be materially different from those in the prospectus or confidential offering materials of a fund or pool.

This article is not investment or tax advice and should not be relied on as such. Verger Capital Management (“Verger”) specifically disclaims any duty to update this article. Opinions expressed herein are those of Verger and are not a recommendation to buy or sell any securities.

This article may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although Verger believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed. Except where otherwise indicated, all of the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor's fees or other trading expenses.