Looking Beyond March Madness to the National Invitation Tournament

The NCAA Tournament, affectionately known as March Madness, is something we get very excited about at Verger. Across the Verger office, we have our favorite teams and players, and some of us follow our alma mater very closely. However, our passion for college basketball doesn’t stop there. We also enjoy following the lesser-known sibling of March Madness: the National Invitation Tournament (NIT).

Despite the lack of name recognition, the NIT has a rich history dating back to 1938, making it one of the oldest postseason college basketball tournaments. Over the years, it has provided an additional opportunity for teams to compete outside of the NCAA Tournament, making it a special watch for devoted fans of college basketball.

While the NCAA Tournament garners the spotlight with its fanfare and frenzy, it's the NIT that offers a quieter, more specialized viewing experience. In a similar way, the first quarter of 2024 saw large-cap stocks and splashy themes such as Artificial Intelligence (AI) continue to dominate financial headlines, while a more nuanced review revealed note-worthy insights and gains in other areas.

Looking to the remaining quarters of 2024, general market sentiment suggests a cautious optimism, with investors very focused on the widespread forecasts of a soft landing for the economy. However, we at Verger know that a dependable team, whether it be playing basketball or investing, doesn’t lose sight of the balance between offense and defense. While uncertainties loom, notably surrounding the Federal Reserve’s response to persistent inflation and evolving fiscal dynamics, we feel an adaptable investment strategy continues to be key.

Market Review

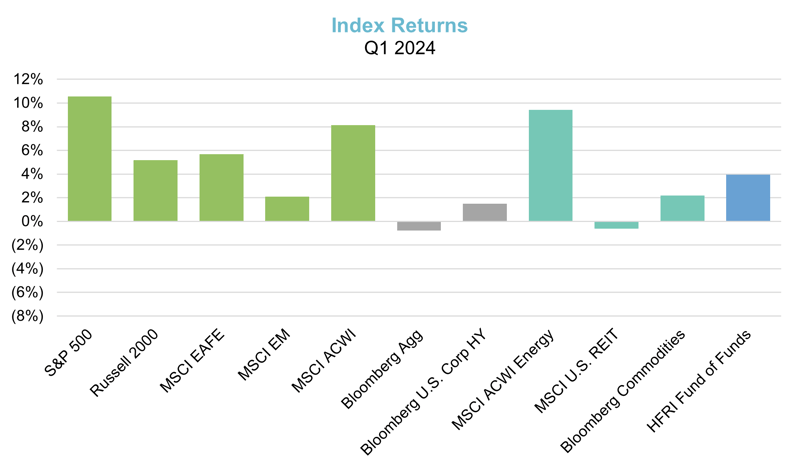

Continuing one of the main market themes from 2023, U.S. equities performed better than non-U.S. markets during the first months of 2024. Within U.S. equities, large cap growth was the top performing market segment. The S&P 500 had another very strong quarter, returning more than 10%. This strong rally was somewhat surprising, given that market expectations for interest rate cuts from the Federal Reserve, which were a key driver of results in 2023, have been substantially reduced since the beginning of this year.

Bond returns (both investment grade and high yield) were fairly muted for the quarter. While returns for the broad commodity markets were not extreme (only up ~ 2%), energy equities were up more than 9% as oil prices had a strong rally during the quarter.

Source: Bloomberg

With large cap growth stocks capturing most of the attention during the quarter and over the past year, it’s worth (again) noting the importance of balancing offensive plays (capturing a good portion of the upside when markets are performing well) with solid defensive ones (minimizing portfolio drawdowns during market declines). While offense, in the form of large cap growth exposure, has been the key to performance in 2023 and so far in 2024, let us not forget how necessary a solid defense was during 2022, when public equities (particularly growth stocks) and bonds both had notable declines.

To restate a theme from other recent commentaries, well diversified portfolios have had a difficult time capturing market upside during the last year, especially given the often narrow nature of the rallies, with all eyes (still) on the so called “magnificent seven” stocks (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla).

Market Outlook

While teams’ success in the NCAA Tournament can be a flash in the pan, and hinge on a few valuable players, schools playing in the NIT are often focused on improving team dynamics and cohesion for future seasons. Similarly, Verger’s success is most appropriately measured and evaluated on a cumulative basis – not season by season, or year by year, but, instead, over multiple years that capture full market cycles. We know from previous market cycles that robust diversification is key – especially when protecting a portfolio on the downside.

And despite general market optimism, there’s still, in our view, plenty of potential market risks. We’re not making a bet about whether a recession or a soft landing may occur. But when we look at the broad markets, we believe investors could be in for some potential disappointment (and the markets in for resulting downside volatility) if the economy fails to meet growth expectations or enters a recession.

In addition, another potential source of market volatility relates to the Federal Reserve, if inflation stays higher for longer and/or interest rate cuts are less than expected. It is interesting to note that, even with the consensus of falling inflation, gold continues to trade at or near all-time highs. Perhaps this represents investors’ concerns about our country’s fiscal situation, as debt levels continue to increase.

As always, but especially during this period of uncertainty, we believe investors need a diversified, all-weather, and antifragile portfolio that can perform reasonably well over a wide range of market conditions and environments. While we believe investors should have exposure to equities and other risk assets, which can perform well under more favorable economic conditions, we also believe in exposure to other strategies, such as real assets and absolute return-oriented hedge funds, which are important for less-benign market environments.

Market Opportunities

When we think about the overshadowing popularity of the NCAA Tournament and the more under the radar opportunities for teams playing in the NIT, we can’t help but notice parallels between current and wildly popular investment strategies and our views on more efficient ways to play two current themes – Artificial Intelligence (AI) and Fixed Income.

Artificial Intelligence (AI)

The popular way among most investors to play the AI theme is to buy the companies (for example, NVIDIA) that are producing the graphic processing units (GPUs) and other devices for the large technology companies that need this hardware. While NVIDIA and similar companies have indeed been growing rapidly, their valuations may reflect most, if not all, of this good news.

Another potential concern with technology companies is that someone else can come along and develop a “better widget.” Jason Zweig, in a 2/23/24 Wall Street Journal article, highlighted such previous “disruptive technologies” that ended up being disrupted. For example:

• Smart phones: The Blackberry peaked at 85M users - then was eclipsed by the iPhone

• Search engines: Go.com and infoseek were both crushed by Yahoo, who was then decimated by Google

• Computer networking: Cisco Systems was the dominant player - then came cloud computing, led by Amazon and Microsoft

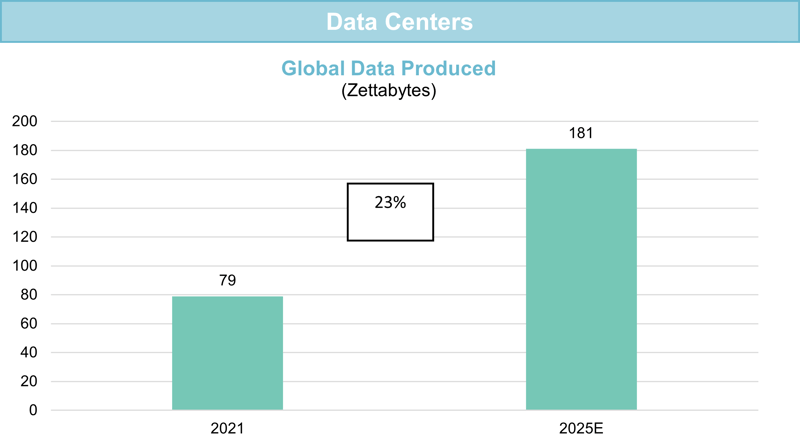

Keeping these important lessons in mind, we have elected to play the AI theme a different way: through a commitment to a digital infrastructure manager that focuses on data centers. Regardless of which companies end up being the long-term winners in AI, the amount of global data being produced is likely to continue to increase, which should bode well for data center growth.

Source: Proprietary research, digital infrastructure investment manager

Fixed Income

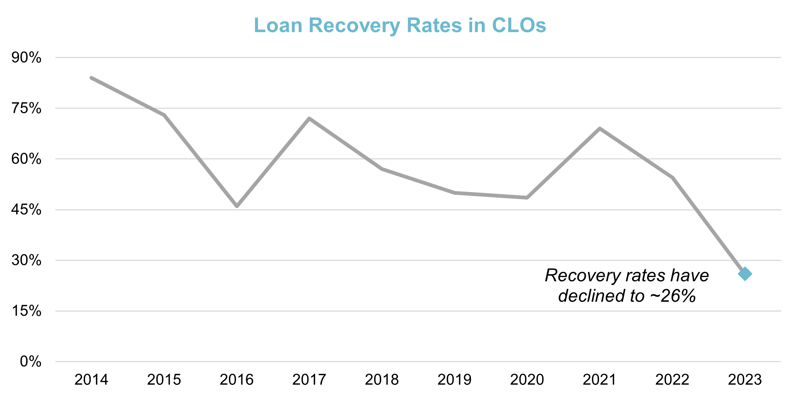

Two current popular strategies within fixed income are private credit and long only U.S. corporate credit (both high yield and investment grade). With private credit, our general concerns are that many of these private credit managers have never managed portfolios during a similar interest rate environment and/or do not have the requisite experience and skill set to manage these loans through a potential workout or restructuring. Another potential worry, as per the chart below, is that loan recovery rates have declined significantly over the last few years.

Source: Bank of America Global Research, data as of 9/11/23. Recovery rate based on loan price 30 days post default.

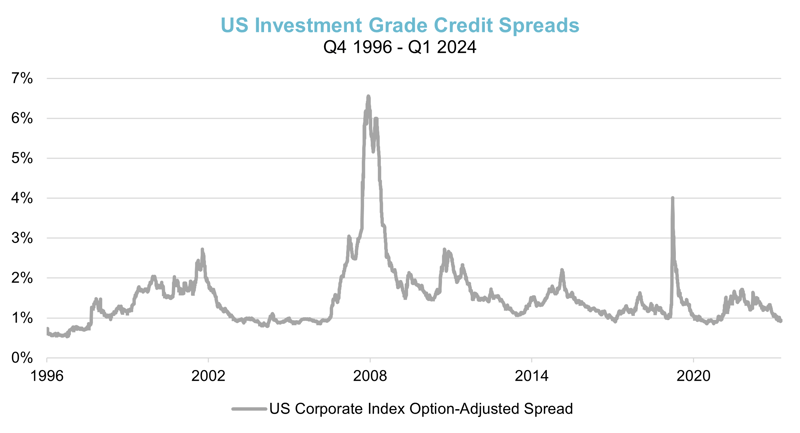

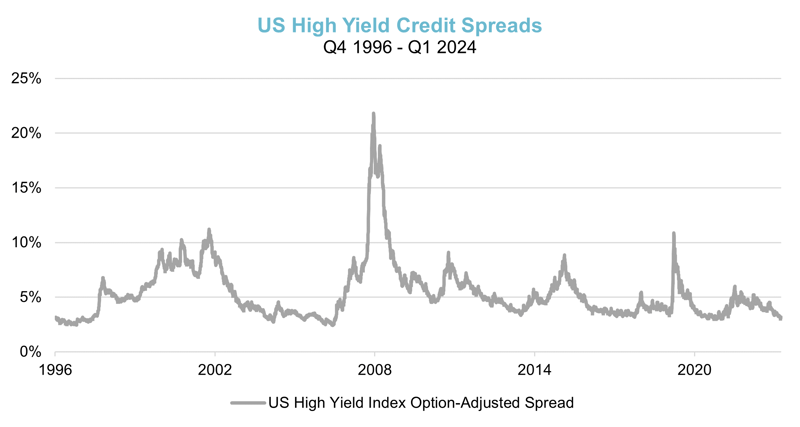

With long only public credit (both investment grade and high yield), we believe that most of the good news is already reflected in market prices. Per the two charts below, spreads are at or near all-time tight levels. We believe the outlook from here for credit spreads is quite asymmetric, and not in a good way. More specifically, we feel spreads are unlikely to tighten much more, even with good economic or corporate news. However, we also believe that spreads are much more likely to widen, potentially quite significantly, if the economy slows down.

Source: Bloomberg

Source: Bloomberg

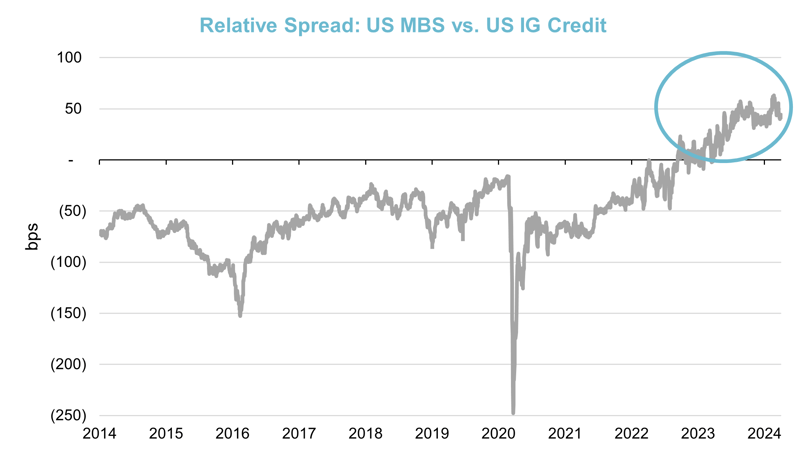

As a result, we are finding more attractive opportunities in other, less mainstream areas of fixed income. In the hedged credit space, we can take advantage of idiosyncratic opportunities on both the long and short side. In emerging markets, we can find inefficient markets across countries, often involving some form of restructuring. Finally, in the mortgage space, we currently see wider spreads, which is unusual since mortgage spreads are normally tighter than investment grade credit (see chart below).

Source: Bloomberg

Closing Thoughts

March Madness frenzy, with the focus on speculative brackets, is great entertainment, and, if you can cut through the noise, great basketball. The NIT, however, is a quieter experience: a time-honored tradition that provides valuable opportunities for teams, players, and coaches to compete, develop, and achieve success on the college basketball stage. We appreciate that.

At Verger, our mantra is Protect, Perform, and Provide. We are disciplined in our investment approach, which requires a careful practice of tuning out the noise and avoiding short-term focused plays despite the associated hype. By embracing the lessons of the NIT—resilience, adaptability, and the pursuit of excellence—basketball coaches devise game plans that include offensive and defensive strategies, player rotations, and potential adjustments based on the opponent's strengths and weaknesses. Similarly, in navigating market volatility, Verger develops investment strategies based on factors like risk tolerance, asset allocation, and market conditions to capitalize on the opportunities for growth and success that lie ahead.

All investments involve risk, including possible loss of principal.

Not all strategies are appropriate for all investors. There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives. Diversification does not ensure a profit or protect against a loss.

One cannot invest directly in an index, and unmanaged indices do not incur fees and expenses.

This article is being provided for informational purposes only and constitutes neither an offer to sell nor a solicitation of an offer to buy securities or otherwise engage Verger Capital Management for investment advisory services. Offerings of securities are only made by delivery of the prospectus or confidential offering materials of the relevant fund or pool, which describe certain risks related to an investment in the securities and which qualify in their entirety the information set forth herein. Statements made herein may be materially different from those in the prospectus or confidential offering materials of a fund or pool.

This article is not investment or tax advice and should not be relied on as such. Verger Capital Management (“Verger”) specifically disclaims any duty to update this article. Opinions expressed herein are those of Verger and are not a recommendation to buy or sell any securities.

This article may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although Verger believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed. Except where otherwise indicated, all of the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor's fees or other trading expenses.