When Economic Forecasts Mirror New Year's Resolutions

Economic forecasts, like New Year’s resolutions, are often made to be broken. Throughout January, it’s common to hear friends and colleagues joking about how unexpected circumstances have already knocked them off the course of following through on their resolutions. Similarly, economists and Wall Street forecasters have an unreliable track record when it comes to successfully predicting economic and market trends, although you won’t always hear them admitting so freely that things didn’t pan out.

So, why do people repeatedly make these resolutions and forecasts when they are all too familiar with the struggle to keep them and the high probability that they’ll be wrong? Likely because it's easy - and it gives them a (false) sense of action. Not to mention overconfidence, which takes the form of “this time will be different” wishful thinking, or confirmation bias, which is the result of selective information processing.

It’s often said that the difference between a dream and a goal is a plan. For this quarter’s commentary, we’ll reflect on the human instinct to make proclamations (whether in the form of New Year’s resolutions, or economic forecasts) without a plan or process for following through.

At Verger, we feel it’s important to remember that, in the end, forecasts are primarily about probabilities. In this ever-changing landscape, as we move into 2024, let's approach the future with a realistic understanding of its inherent uncertainties.

Market Review

During the final quarter of 2023 (and to-date into 2024), forecasters have largely ignored their previous warnings about the staying power of inflation and impending recession and pivoted to a new narrative, telling of a resilient economy, central bank rate cuts, and the delivery of a soft landing. The consensus expectation echoing throughout Wall Street has been that the Federal Reserve will reduce interest rates (early and often) in 2024.

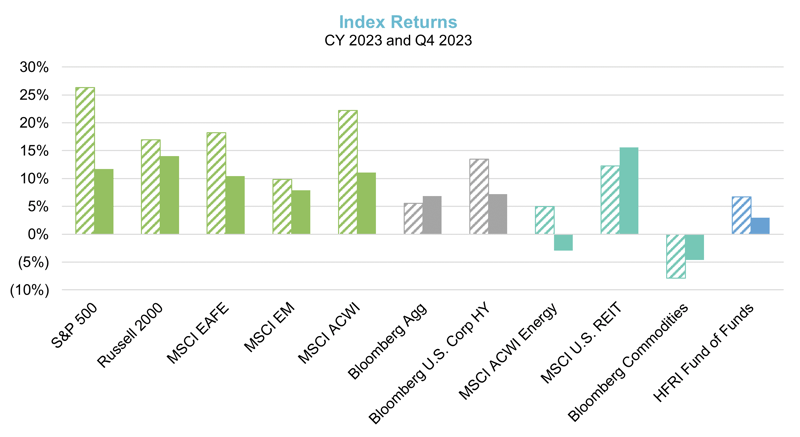

Due in large part to these expectations, stocks and bonds staged tremendous rallies during November and December 2023, leading to very strong returns during the quarter. Most equity markets returned over 10% for the quarter, while bonds (both investment grade and high yield) returned ~7%.

For the year, equities generated very strong returns, with large cap U.S. stocks leading the way (+26%). Developed international equities returned +18% while emerging markets were +10%. Investment grade bonds finished the year +6% while high yield bonds returned +13%.

CY 2023 = line pattern fill Q4 2023 = solid bar

Source: Bloomberg

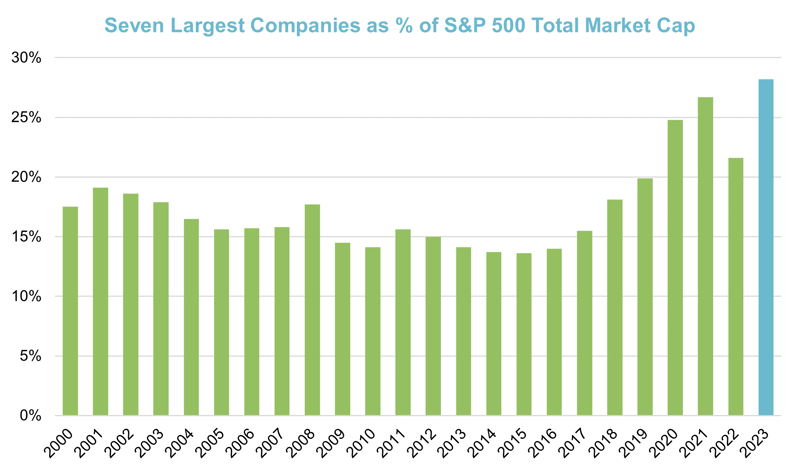

Continuing a trend from previous quarters, U.S. equity returns were very concentrated during Q4. In the end, the so called “magnificent seven” stocks (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla) generated ~ 50% of the S&P 500’s return for the year. What’s more, 2023 was the first year ever to see 3 sectors up more than 30% (Technology, Communication Services, and Consumer Discretionary), with 3 sectors also down at least 2% (Utilities, Energy, and Consumer Staples).

Strong returns from this handful of companies has led to the S&P 500 index being more concentrated than at any time over the last 20 years.

Source: Blackrock

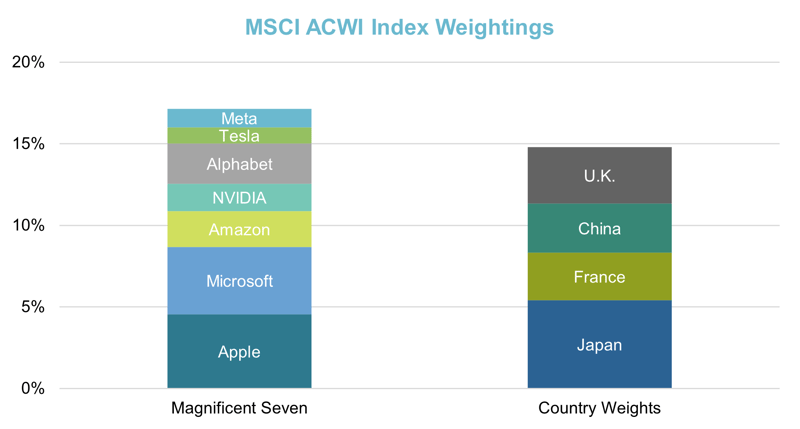

To give another example of the magnificent seven’s disproportionate representation, the chart below shows that five of these companies have as much weight in the MSCI All Country World Indices as four countries.

Source: Bloomberg

In our view, the key question for the magnificent seven is not whether they are profitable, growing companies that are likely to be key players in their respective industries. Instead, we wonder whether investor expectations (and valuations) are now so high that these companies, and, in turn, the indices they are dominating, are likely to disappoint going forward. To put it another way, sustaining the current valuations for this small group of companies feels more like a dream than an achievable goal. Especially because there may be a mismatch between investors’ broad excitement about new technologies and these companies’ concrete plans for future implementation and their resulting profitability.

Market Outlook

As the bullish narrative for the market’s future continues to gain steam and the expectation (or, perhaps more accurately, the hope) of a soft landing for the economy prevails, there are still many (ourselves included) who remain cautious. Historically, the end of a Fed tightening cycle does not necessarily signify a soft landing. In fact, a recent analysis by The Economist shows that a spike in financial press articles mentioning a soft landing is typically followed by a recession.

Also of mention, we’ve seen historically that during significant equity market declines (including the early 2000s and the Global Financial Crisis), most of the drawdown occurs after the Fed begins reducing interest rates.

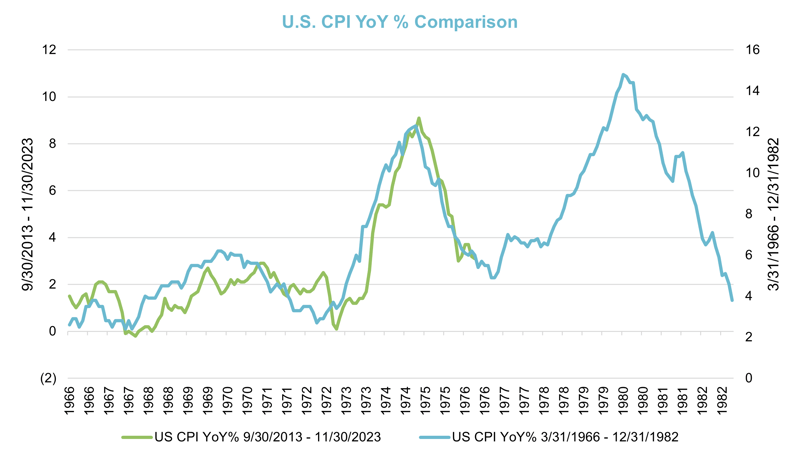

All of this is to say that, like doomed New Year’s resolutions, faulty assumptions about further rate cuts and a soft landing will be the most expensive for those who have failed to consider the ramifications of other outcomes (for example, what’s the cancelation policy for that new gym membership?). While we’ve seen reported inflation numbers decline recently, this short-term trend is not guaranteed to continue. Per the chart below, we see some unsettling similarities between the current 10 year period (2013 – 2023) and a prior, 20 year economic cycle where inflation ebbed and flowed (1966 – 1982). If the path for inflation over the next 10 years is similar to that of the 1970s and 1980s, then we will be in for a wide variety of outcomes that most forecasters are not currently considering.

Source: Bloomberg

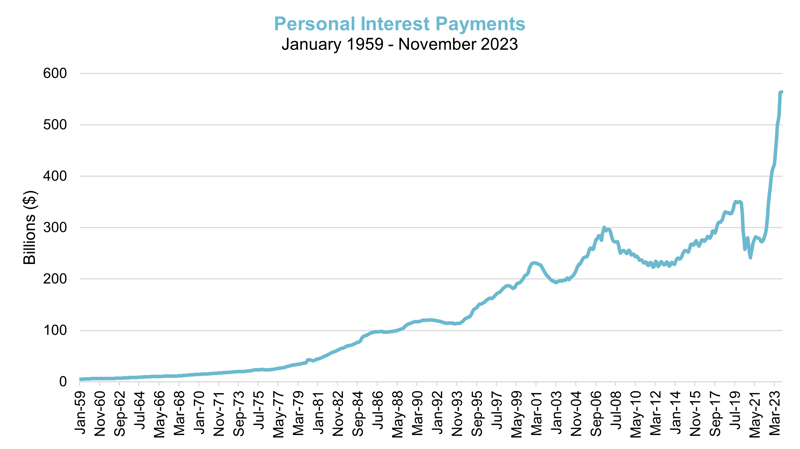

Further (and as we’ve mentioned in earlier 2023 commentaries), we continue to wonder if/when the impacts of inflation, coupled with higher rates on loans (e.g., auto, credit card) will impact overall savings and change consumers’ spending patterns. As demonstrated below, personal interest payments are currently at an all time high. What will the impact be on corporate profits if/when the consumer is forced to reduce spending?

Source: St. Louis Fed

Source: St. Louis Fed

These concerns bring us back to the idea that any forecast is based on probabilities. Instead of banking on the prevailing bullish narrative playing out, we at Verger are keen to continue exploring the inherent uncertainties, the various probabilities of different outcomes, and the resulting broad range of potential investment opportunities.

Market Opportunities

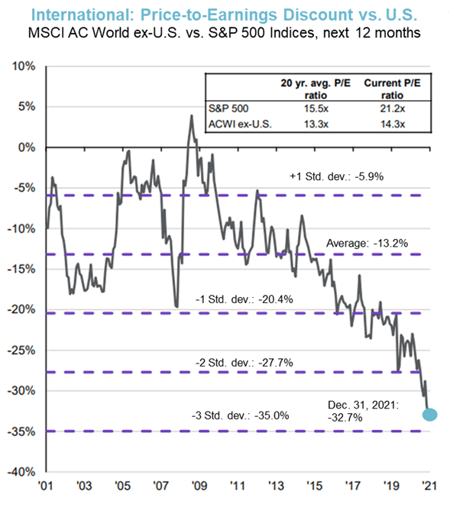

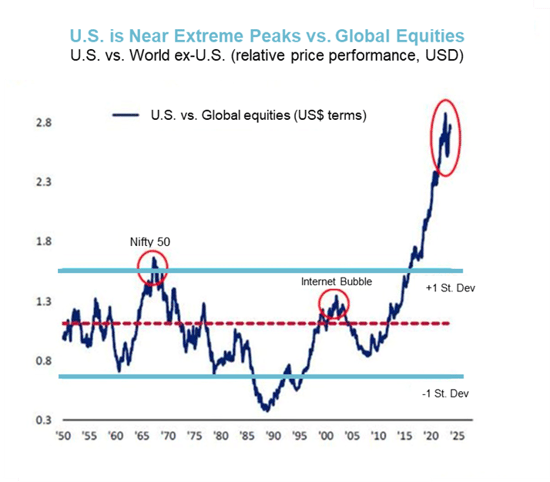

To that end, even with the potential macro concerns highlighted above, we (and our managers) continue to find attractive investment opportunities. Within public equities, we prefer quality stocks (companies with higher and more stable profitability and lower leverage) and non-US equities (including Japan). The preference for the latter is due in part to their extreme valuation discount compared to the U.S. (as shown in the first chart, below), as well as the significant outperformance of U.S. equities over the last decade plus (as highlighted in the second chart, below).

Sources: JP Morgan (left) and BofA Global Investment Strategy, Global Financial Data (right)

In addition, we believe hedged equity strategies have attractive opportunities to generate returns on both the long and the short side.

On the long side, our managers are seeing attractive opportunities outside of the magnificent seven. One such area is in mid-cap software companies. In 2021, software companies traded at enterprise valuation levels of ~17x sales. In late 2023, one of our managers was able to purchase mid-cap software companies at much cheaper valuations (~3-5x sales). Software business models, with high gross margins and low capex and working capital requirements, have more flexibility to adjust their profiles to a potentially more challenging macro environment.

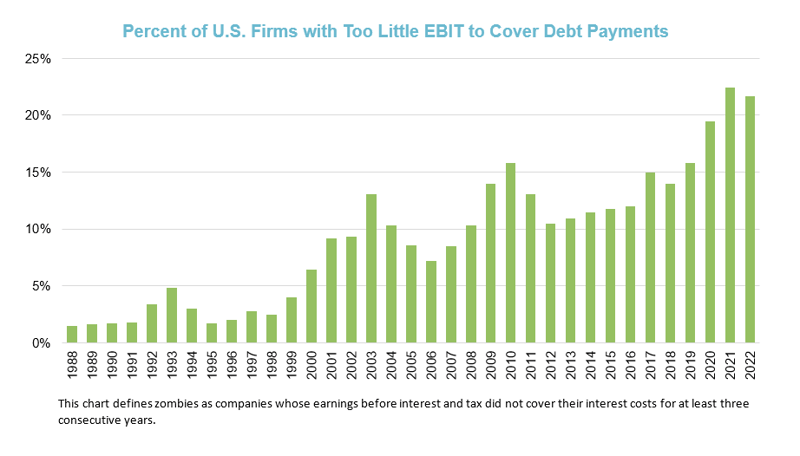

On the short side, there continue to be plenty of companies that are not generating enough earnings to cover their debt payments (these companies are also known as “zombies,” see chart below). Going forward, the number of these companies could likely increase, given a potentially slowing economy and a higher interest rate environment. This can provide ample opportunities to profit on the short side.

Source: Fathom Consulting

In addition, our managers are closely evaluating the AI space, as many companies seem to be promoting AI glory and positioning themselves as beneficiaries of the “AI wave,” despite their potential deficiencies in the intellectual property, assets, or engineering expertise required to adequately (or competitively) pursue the technology.

Closing Thoughts

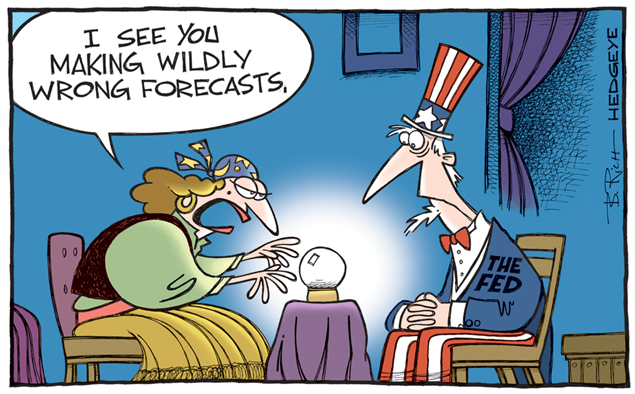

In recent years, one of the most popular topics among forecasters has certainly been the Federal Reserve (and central banks around the world). But as the forecasters stare into their crystal balls at these policymakers, the central banks are busy making their own assumptions about the future (i.e. gazing into their own crystal ball). These layered complexities should result in doubt - but forecasters are constantly making bold proclamations about the Fed’s next moves, and (all too often) investors are making tactical moves based on these predictions. It’s no wonder that strong market reactions to Fed rate increases or decreases are common: investors who bought wholeheartedly into the wrong prediction are quick to reverse course.

It's important to remember that even with all their resources, the Fed can struggle to forecast the short-term path of inflation, employment, and GDP. Further, the Fed has a limited toolkit with which they can address these economic challenges. Indeed, through different market cycles, the Fed has been criticized for being everything from too aggressive to being too slow and/or meek.

Ultimately, this is why making predictions about the Fed (or the trajectory of the economy) is akin to making a flimsy New Year’s resolution. Both are proclamations – simply a starting point. For either to evolve into an investment strategy or a change in behavior, they require an implementation plan. In other words, an iterative follow up process, where results are continually evaluated, and the path forward is adjusted accordingly.

At Verger, our investment process is just that. Iterative, and grounded in a long-term view encompassing multiple market cycles. We focus on building all-weather and antifragile portfolios that can perform across all markets. We don’t need a crystal ball or overly optimistic resolutions to be excited for what 2024 has in store. No matter what happens, we feel ready to Protect, Perform, and Provide for our clients.

Wishing you a successful and insightful quarter ahead.

All investments involve risk, including possible loss of principal.

Not all strategies are appropriate for all investors. There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives. Diversification does not ensure a profit or protect against a loss.

One cannot invest directly in an index, and unmanaged indices do not incur fees and expenses.

This article is being provided for informational purposes only and constitutes neither an offer to sell nor a solicitation of an offer to buy securities or otherwise engage Verger Capital Management for investment advisory services. Offerings of securities are only made by delivery of the prospectus or confidential offering materials of the relevant fund or pool, which describe certain risks related to an investment in the securities and which qualify in their entirety the information set forth herein. Statements made herein may be materially different from those in the prospectus or confidential offering materials of a fund or pool.

This article is not investment or tax advice and should not be relied on as such. Verger Capital Management (“Verger”) specifically disclaims any duty to update this article. Opinions expressed herein are those of Verger and are not a recommendation to buy or sell any securities.

This article may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although Verger believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed. Except where otherwise indicated, all of the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor's fees or other trading expenses.