New Year, No Resolutions

The transition to a new year offers opportunities for reflection on the past and a look forward to the year ahead. It’s also a time for New Year’s resolutions where we take stock of the lessons learned over the past year and apply them to our future aspirations. And for a lot of financial firms, it’s a time for predicting what lies ahead and charting the course for the next quarter, year, and beyond.

At Verger, we have the privilege of serving long-term investors – non-profit endowments and foundations with perpetual time horizons. While we remain cognizant of trends and economic indicators, we don’t make predictions or attempt to time markets. However, if 2021 (and 2020!) taught us anything, it’s that markets aren’t always linear or predictable, so it is essential to build resilient portfolios in the face of strong headwinds.

Our investment approach remains consistent – we endeavor to create diversified, all-weather, and antifragile portfolios that perform across all markets. Portfolios designed to both protect against and benefit from the risk and volatility in the market. Thus, our New Year’s resolution is to not make any resolutions, but, rather, to remain resolute in our convictions: control what we can (risk and fees), manage what we can’t control (returns and market volatility), and provide our clients a long-term oriented portfolio designed to Protect, Perform, Provide across all market environments.

2021 Market & Economic Review

The 4th quarter and calendar year 2021 provide further evidence that the economy, the markets, and society, as a whole, are resilient and can adapt in the face of many obstacles. Like many of you, at Verger we have found that we can not only endure but also thrive, regardless of what is thrown our way. This applies to our staff (COVID, remote/hybrid work, etc.) and our client portfolios (inflation, negative real rates, extended valuations, supply chain disruptions, etc.).

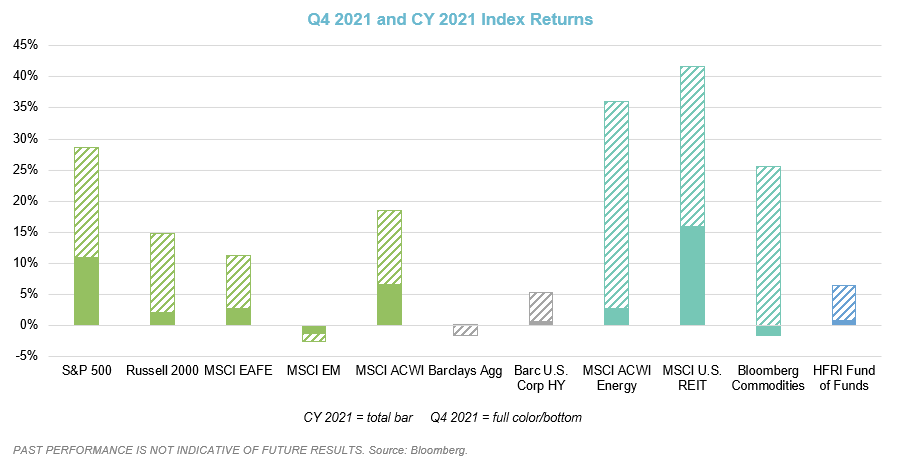

As we look in the rearview mirror, the 4th quarter helped fuel the second year in a row of historically high equity performance. While most markets were positive for the year, some indices like the S&P 500, MSCI ACWI, and MSCI US REIT index delivered nearly half of their returns in the 4th quarter alone.

As we see above, the challenges presented by a new COVID variant, inflationary pressure, supply chain issues, and labor shortages were largely ignored by the markets. And it’s not just market appreciation – earnings for many domestic and international large cap companies have surpassed their pre-pandemic levels. So, what happened? The market is awash in unprecedented liquidity where demand for goods often outpaced inventory due to supply chain issues, and personal consumption grew despite inflated prices and continued lockdowns. But these numbers obscure some of the underlying themes that are central to understanding what drove the market over the past 12 months and what we should focus on for the year ahead.

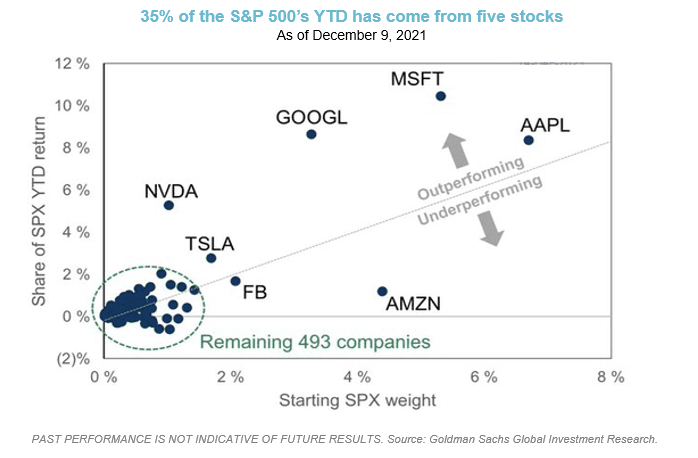

Over the past several years, growth has largely outpaced value, particularly in U.S. large cap equities, where much of the return was concentrated among a small number of growth and technology companies. Although we started to see a reversal and a shift to value in the 4th quarter and the beginning of 2022, a large share of domestic large-cap returns in 2021 was attributable to extended valuations and growing multiples in just five companies.

Alphabet, Apple, Microsoft, Nvidia, and Tesla helped push the S&P 500 to just under a 29% return for the year. The question going forward is whether these growth stocks can sustain the momentum they have displayed over the past decade. What’s priced in already? Is there more room to grow? But it’s not just growth companies. Domestic equities had a great year across the board, with 88% of S&P 500 companies posting positive results (including 12 that were up over 100% for the year!) and the Russell 2000 small cap index returning nearly 15%. These outsized returns are largely attributable to the high levels of fiscal stimulus that provided ample liquidity to support the economic recovery and drive equity multiples.

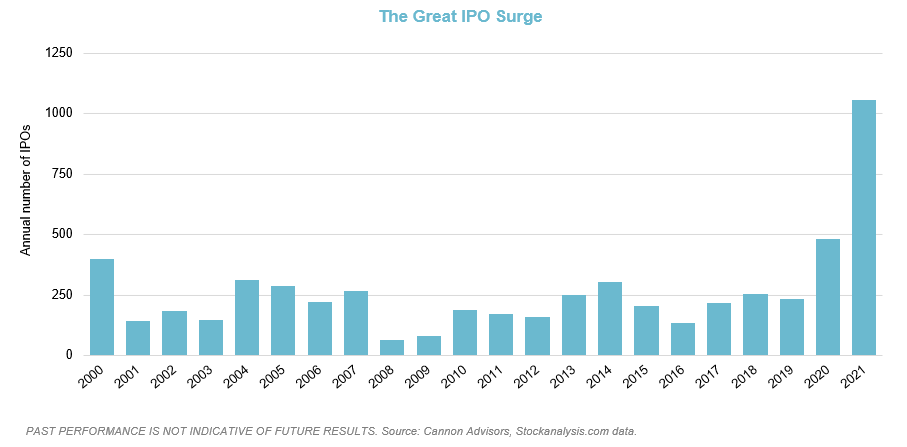

The U.S. venture capital market saw $330 billion of deal value and $750 billion of exit value, which both shattered the previous records. And money continues to pour into venture capital funds, with more than $100 billion in fundraising for the year, also a record. These themes carried over to private equity, where even more records were broken. For the first time in history, private equity firms closed on over $1 trillion of deal value across more than 8,600 deals. In addition, the combined enterprise value of exited companies more than doubled the previous record. The exit environment within private equity mirrored that of venture capital as it generated more than $850 billion of exit value, as managers took advantage of significantly higher valuations. (Data sourced from Q4 2021 Pitchbook report)

Venture capital and private equity were the most significant contributors to Verger’s performance last year. Despite these unprecedented returns, we believe it is imperative to remain disciplined and avoid chasing performance. We will continue to allocate capital to these strategies but do so in the same measured and deliberate way we have since our inception. We will manage liquidity and size commitments appropriately and painstakingly underwrite every opportunity regardless of whether it is a new manager or one with whom we have invested over several fundraising cycles. We know that investing in top-quartile venture capital and private equity managers is imperative for outperformance.

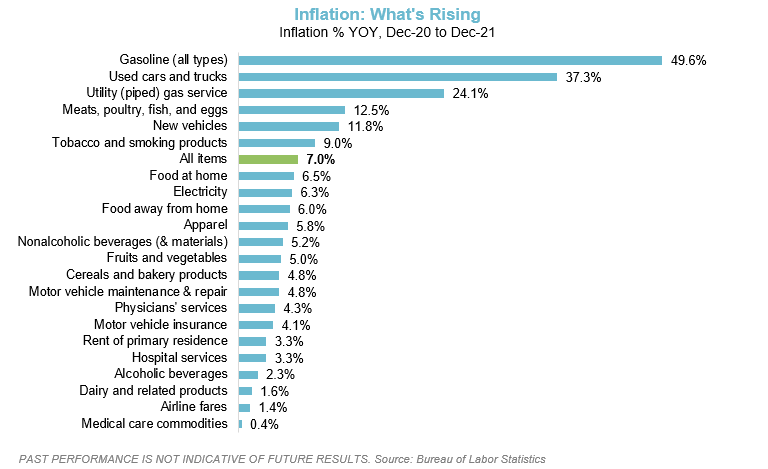

The energy sector outperformed in 2021, with the MSCI ACWI Energy index up 36%. The rocky results of 2020 are well behind the energy sector at this point. Last year there were many premature obituaries written for the energy sector, but it has certainly shown plenty of life in 2021. Commodities surged the most in over a decade this year as a rebound in demand from pandemic lockdowns was the biggest since the 2009 recovery from the Great Financial Crisis. Prices for everything from gasoline and corn to copper and lumber have soared, making it more expensive to fill up the tank, build houses, eat, manufacture cars, and heat homes.

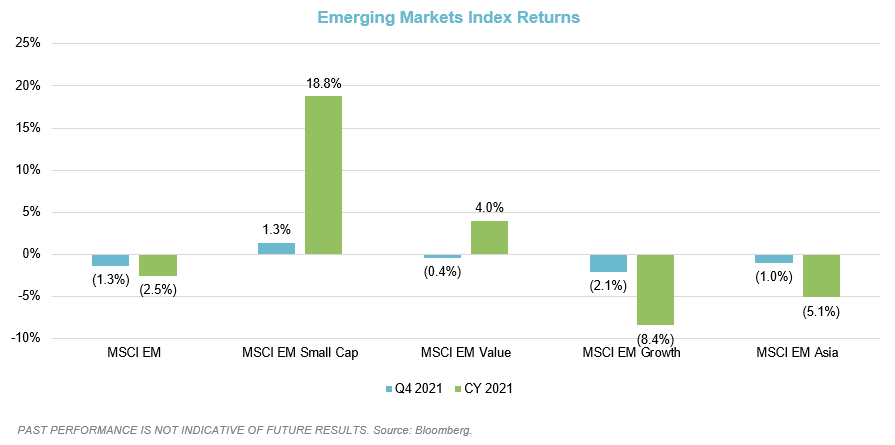

Another trend that played out over the entire year was the underperformance of emerging markets as measured by the MSCI EM index, which was down 1.3% for the quarter and 2.5% for the year. However, much of this underperformance was driven by larger capitalization growth companies in China, some of which were impacted by changes in regulatory oversight. In addition, less attention was paid to the dispersion of performance within the index, as many smaller cap and value names performed well and continue to provide attractive opportunities looking forward. For example, the MSCI EM Small Cap index returned nearly 19% for the year.

Market Outlook for Non-Profit Endowments & Foundations

Of course, all of this begs the question, “Where do we go from here?” Last quarter, last year, and the last several years have been a boon for investors’ portfolios. However, dissecting that performance provides some insight into what worked, what didn’t, and what has the ability to perform going forward.

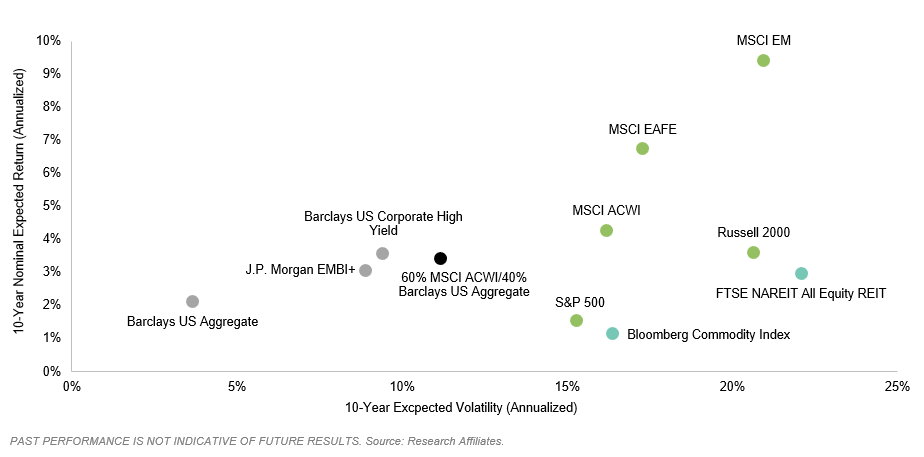

One of the biggest drivers of return has been equities, which has rewarded traditional equity and fixed income portfolios. For example, a simple portfolio of 60% MSCI ACWI Index and 40% Barclays U.S. Aggregate Bond Index was up 10.5% last year. However, the equity side was the only contributor – the Barclays Aggregate was down 1.5% last year. Entering 2022, the markets are in a much different position from the past few years. As illustrated below, expected returns are lower across the entire spectrum of traditional assets, which could make an investor’s life more difficult.

An additional challenge presents itself due to rising rates and inflation. The Fed has begun tapering its bond purchases and has signaled its intent to raise rates over the next several quarters. As rates rise and there is less access to cheap capital, we could see multiple expansion slow and more muted equity returns going forward. Things could potentially be even worse for fixed income. Inflation is now outpacing rates significantly, and we are potentially in store for negative real rates for the foreseeable future. This isn’t to say that last year’s inflation rate of 7% is the new norm, but inflation will likely be elevated above what we saw pre-pandemic.

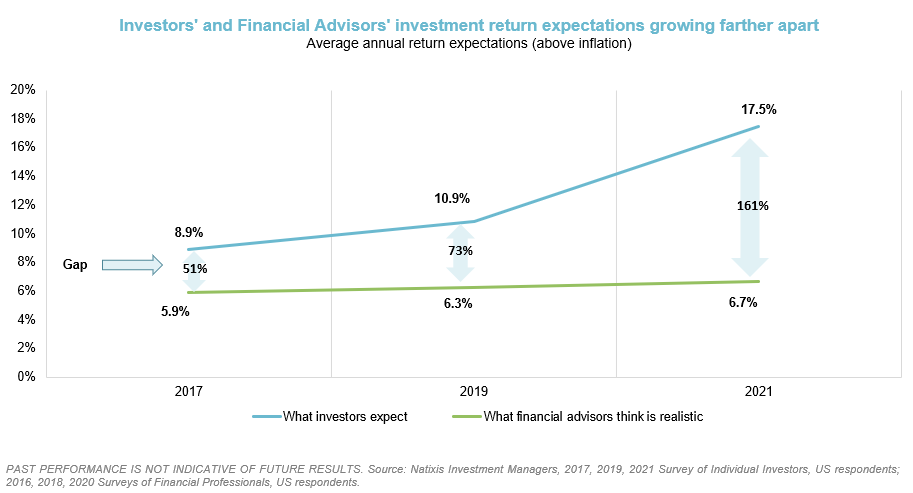

The past decade has generally provided accommodating conditions for stocks and bonds. Still, the triumvirate of lower expected returns, lower rates, and higher inflation makes it difficult to envision outsized returns going forward. Thus, setting realistic expectations is of the utmost importance. Unfortunately, the spread between investors’ return expectations and what the investment industry believes is feasible has widened significantly over the past several years on the heels of historically strong equity performance.

Our goal is to position your portfolio for what’s to come, not what already happened. Does that mean the market won’t continue to run even further, despite what’s happened in the first few weeks of 2022? Does it mean markets rationalize and returns revert to more historical levels? Or does it mean that returns are well below historical averages and investors struggle to meet their return targets? We don’t know. What happens next week, next month or even next quarter is of less concern to us than what happens over the long run.

Regardless, the most significant risk for long-term investors is not poor short-term outcomes but, rather, poor long-term ones. Our view is that we are in an environment where market risk is high for many traditional assets, while at the same time, the expected return for many risk assets is declining. So, it will be imperative to look beyond the traditional 60/40 portfolio and reframe our ideas about what diversification means.

Market Opportunities: Absolute Return

As frequent readers of Verger’s commentaries will already know, our approach often leads us to unique opportunities for diversification and return generation. This has led us to make investments in small-cap Japanese equities, emerging markets, carbon trading, and 5G communication towers. Given the current environment of lower expected returns for most traditional asset classes, we believe investors may need to continue looking for unique opportunity sets. This means focusing on smaller, more granular market segments or venturing into more niche opportunities that are less correlated to the broad markets. Even traditional diversifiers like the private markets or commodities have become more correlated recently as inexpensive and seemingly unfettered access to capital has inflated valuations and fundraising volume.

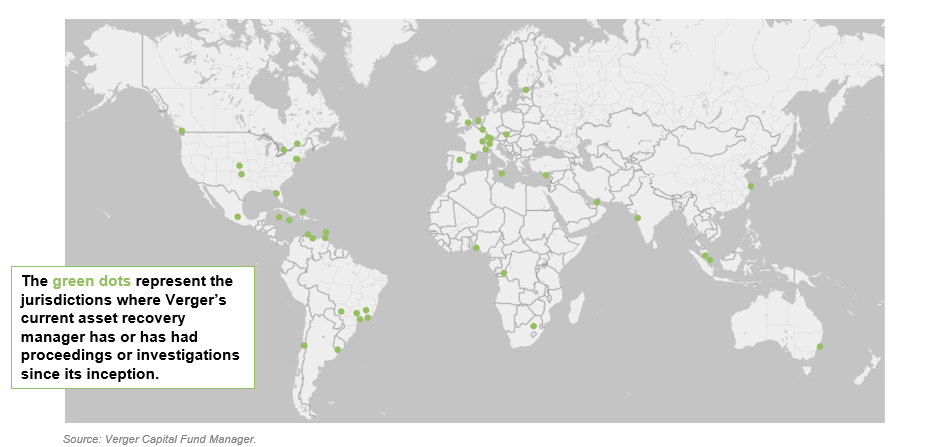

Litigation finance is one opportunity we view as both a diversifier and a provider of uncorrelated returns. This is the practice of providing financing to the plaintiff of pending or settled litigation to assist with asset recovery in exchange for a portion of any recovered assets. There is an added benefit in that this financing often funds the recovery of assets, financial or otherwise, that have been siphoned away from their rightful owners through fraud or corruption. According to a 2020 United Nations report, there is an estimated $1 trillion paid in bribes and approximately $2.6 trillion stolen through corruption annually, representing approximately 5% of global GDP. Most victims of these crimes, be they individuals, corporations, or even sovereign entities, do not have the financial expertise or resources to recover these assets on their own. Verger has engaged with a manager that works with the victims of this fraud and corruption by financing the discovery and recovery of these stolen assets. Litigation finance is a growing alternative asset class that is typically uncorrelated to capital markets, has the potential to provide outsized returns, and often has shorter liquidity terms than other private strategies.

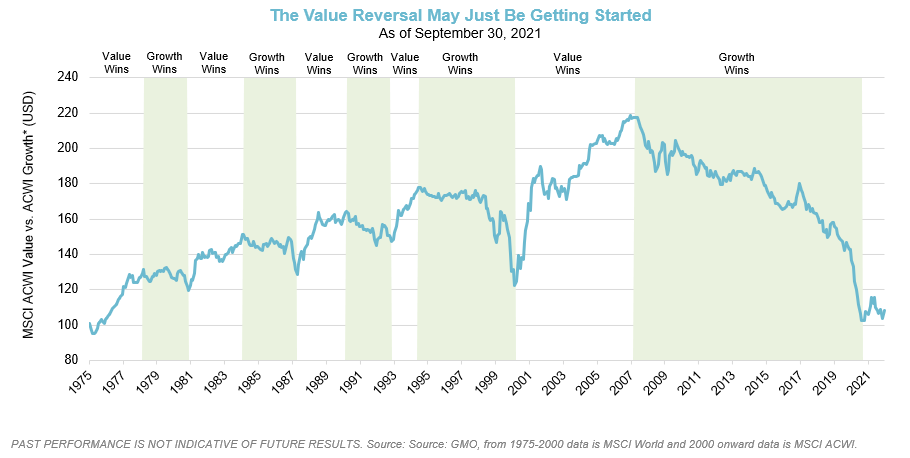

Another strategy that is potentially more familiar but has been out of favor in recent years is long/short. While the historical run in the equities markets has generally outpaced all but a few long/short managers, we have not abandoned the strategy. Instead, we remain convinced of its viability and potential to partially insulate a portfolio from high beta correlation to the broader market. In their simplest form, many long/short strategies are designed to go long what’s cheap and short what’s expensive. In December, Verger allocated capital to a new long/short strategy that seeks to take advantage of an extensive valuation spread between value and growth stocks. As the graphic below illustrates, growth companies have outpaced value companies for over a decade, dating back to the Global Financial Crisis of 2007 – 2008.

We see an opportunity to exploit these inefficiencies with a manager who we believe has the skill to short more speculative, overpriced growth companies and buy higher quality value companies that are under-appreciated by the market. This provides our clients the ability to benefit from the trade itself and potentially helps to hedge their growth exposure (e.g., venture capital), which has generated significant gains over the last few years.

Our OCIO Perspective

“May you live in interesting times.” This idiom, which was at one time purported to be an ancient Chinese curse (an origin story that has since been disputed), was quoted by Robert Kennedy during a speech in 1966. He added, “Like it or not, we live in interesting times. They are times of danger and uncertainty; but they are also more open to the creative energy of men than any other time in history.” Kennedy’s speech took place in Cape Town, South Africa, and he was referencing global instability that he viewed as a challenge to liberty, freedom, and western democracy. However, Kennedy’s words are applicable today for different reasons. We are in the midst of a global pandemic that has challenged governments, economies, and us as individuals for over two years. In the face of uncertainty, we have seen tremendous resilience and fortitude as populations have mobilized against a common “enemy.” But outcomes have often been puzzling and even counterintuitive at times, particularly in the financial markets.

As investors, our job at Verger is to help navigate the uncertainty and confusion presented by the multitude of variables impacting the current environment – inflation, growth, volatility, and valuations, among others. The challenge is that there is no playbook to follow as we chart the route ahead, and as the last two years have proved, many prognosticators have found their predictions to be wrong. So, if we can’t predict the future, we must, at the very least, prepare for it.

At Verger, we are humble enough to admit what we can and can’t control. We can’t control inflation, which is likely here to stay. And it is certainly not transitory, despite Chairman Powell’s past assertions, which reminded us of a favorite quote from Inigo Montoya in The Princess Bride – “You keep using that word. I do not think it means what you think it means.” We can’t control market volatility, which has returned in fits and starts, particularly toward the end of 2021 and the beginning of 2022. We can’t control returns. We can’t control investor sentiment.

So, what can we control? First, we can control risk by diversifying the portfolio, shifting away from overvalued assets, into out of favor assets, and seeking uncorrelated investment strategies. Second, we can control liquidity to ensure that our clients have ready access to capital to fund their operations and to be able to exploit market opportunities in times of dislocation. Third, we can control expectations – we don’t expect, nor do we rely on, the continuation of excess equity returns to be the sole determinant of our success. We can control the probability of success by focusing on the next ten years and not the next ten days or weeks.

At Verger, we remain humble, hopeful, and motivated to build upon our all-weather, antifragile approach. We look forward to the year ahead and the continued opportunity to serve our clients and their missions.

Verger’s quarterly investment webinar covers market review and outlook in more depth and is open to qualified investors. To request an invitation to the next webinar on February 3, 2022, please contact us using the form found here.

All investments involve risk, including possible loss of principal.

Not all strategies are appropriate for all investors. There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives. Diversification does not ensure a profit or protect against a loss.

One cannot invest directly in an index, and unmanaged indices do not incur fees and expenses.

This article is being provided for informational purposes only and constitutes neither an offer to sell nor a solicitation of an offer to buy securities. Offerings of securities are only made by delivery of the prospectus or confidential offering materials of the relevant fund or pool, which describe certain risks related to an investment in the securities and which qualify in their entirety the information set forth herein. Statements made herein may be materially different from those in the prospectus or confidential offering materials of a fund or pool.

This article is not investment or tax advice and should not be relied on as such. Verger Capital Management (“Verger”) specifically disclaims any duty to update this article. Opinions expressed herein are those of Verger and are not a recommendation to buy or sell any securities.

This article may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although Verger believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed. Except where otherwise indicated, all of the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor's fees or other trading expenses.