During COVID, many of us at Verger, and likely many of you, have turned to TV and streaming services to stave off the effects of isolation induced boredom and quickly fell in love with Apple’s hit show, “Ted Lasso.” For those not familiar, the series centers on an American football coach inexplicably hired to manage an English football (i.e., soccer) team, despite the obvious hindrance of having never coached or played soccer – or even having a basic understanding of the rules, for that matter. While Ted’s fictional team, AFC Richmond, may provide the backdrop for the series, Ted Lasso isn’t really about soccer at all. It’s a story of relationships, character, strength, and perseverance, which is why it’s no surprise the series developed such a following during the depths of the pandemic. The eponymous lead character’s outlook on life can be summarized in one word – positive. So positive and hopeful that he has the word “Believe” plastered across his office, his team’s locker room, and even his home.

Source: Apple TV+

Source: Apple TV+

As we reflect upon Ted Lasso and its themes, we can’t help but see similarities with the narratives that are driving the markets today, where fundamentals have taken a back seat to storytelling. Whether it’s buying shares in a distressed movie theater so retail investors can “stick it to the man,” a bankrupt rental car company buying 100,000 electric cars and somehow adding $300 billion to the market cap of an electric vehicle company, or the government telling consumers that inflation is not an issue, regardless of record paced price increases in food, housing, and energy. Despite evidence to the contrary, it seems most investors are willing cast aside the headwinds of inflation, supply chain issues, political division, or other negativity to just BELIEVE.

Verger’s quarterly investment webinar is open to qualified investors only. To request an invitation to next quarter’s call, please contact us using the form found here.

Q3 2021 Market & Economic Review

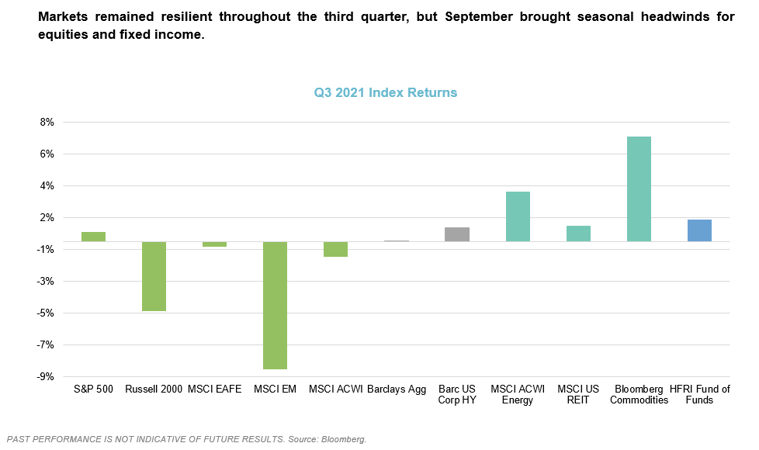

Domestic markets remained resilient in the 3rd quarter, but September brought some seasonal headwinds that impacted the markets broadly. The S&P 500 was down 4.7%, posting its worst month since March of 2020 during the onset of the COVID-19 pandemic in the U.S., yet managed to end the quarter slightly positive. Small caps fared worse, ending the quarter down nearly 5%. The September selloff in domestic equities was likely driven by growing political and regulatory concerns resulting from policy battles over taxes and government spending. On a more positive note, capital markets remained strong in the U.S. with 770 IPO’s occurring year to date representing more than 3x the 10-year average and surpasses the annual record of 480, set just last year (prior to last year, the record was 397 dating back to 2000). Additionally, the Bloomberg Commodity Index recorded its largest annual gain in 42 years as supply and demand disparities drove energy prices higher.

Although international equity markets fared worse than their domestic counterparts, this was largely driven by emerging markets, particularly China, which makes up over 1/3 of the MSCI EM Index as of September 30, 2021. Concerns over increasing Chinese government regulation in specific industries has driven shares lower, particularly within real estate where over-levered companies like Evergrande suffered the most. However, the impact of proposed or enacted government regulations also extended to sectors like education and consumer technology. Despite short-term setbacks, international equities remained less expensive by most valuation measures as compared to their domestic counterparts, which may offer longer-term growth and diversification opportunities, particularly should U.S. markets falter at some point.

One area that continues to be a concern and could potentially serve as a catalyst for volatility in markets, particularly in the U.S., is inflation. Increasing consumer demand, fueled by stimulus payments, rising wages, and the upcoming holiday season has encountered inadequate supply as supply chains suffer from logistics issues, labor shortages, and rising energy prices. Congestion issues that began at major ports over a year ago have gotten worse and we expect that trend to continue through much of 2022 with increased backlogs and escalating shipping costs. This is exacerbated by chronic labor shortages and higher energy prices that impact logistics companies. Natural gas became the single most important natural resource in the U.S. and accounts for a large percentage of power generation in many states (40% in New York, 60% in California, and over 70% in the New England region). At the same time, natural gas prices have risen more than 100% this year as domestic supply has decreased by 12%. If this trend continues, Americans face an extended period of higher electricity and heating costs.

What do you get when you pair supply and demand imbalances with supply chain disruptions and accelerating energy costs? Higher prices across most industries with no sign of near-term relief. The Fed updated their 2021 inflation outlook in September to over 4%, but they expect it to be closer to their 2% target in 2022. Consumer expectations are much less optimistic as they expect inflation to surge to 5.3% next year and 4.2% for the next three years. Market uncertainty will likely remain elevated as investors and consumers alike digest the Fed’s long awaited and highly telegraphed tapering of bond purchases and what that may imply for future interest rate moves.

Longer term, we’re not sure where inflation ultimately lands, but we’re fairly confident that it’s not transitory. Regardless, inflation, when paired with logistics and supply issues, should make for an interesting holiday season. Verger’s advice? Shop early and shop local.

Market Outlook for Non-Profit Endowments & Foundations

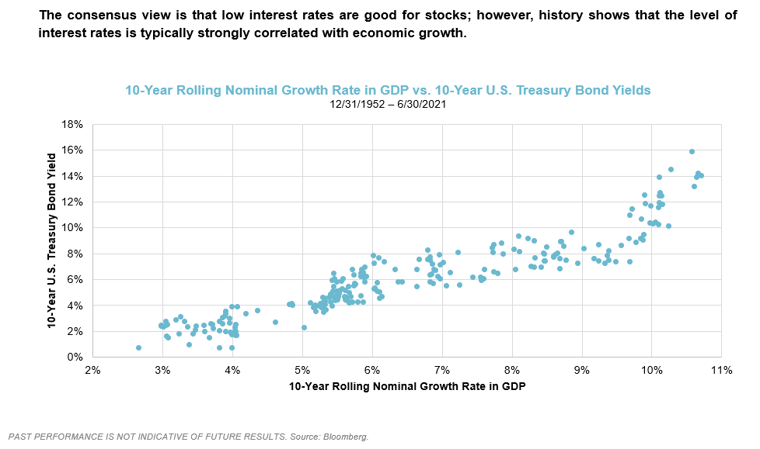

Interest rates remain the topic du jour among many investors as they attempt to interpret what this extended low-rate environment means for forward growth expectations. Historically, the consensus view has been that low interest rates are good for equities, and we believe that to an extent, that makes sense. The future earnings of a company should be worth more if rates are lower. However, that assumption does not account for one potential downside of lower rates – lower economic growth. As the chart below illustrates, there has traditionally been a strong correlation between the level of interest rates and future economic growth. Lower interest rates often signal lower economic growth, which has the potential to negatively impact companies, their share prices, and, ultimately, their investors.

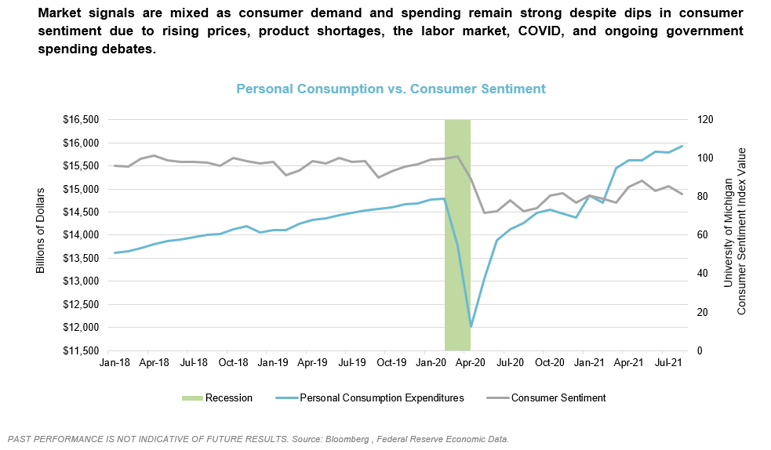

Interest rates aren’t alone in their tendency to deliver mixed signals. While personal consumption levels have recovered from the depths of March 2020 and have extended well beyond their pre-COVID levels, consumer sentiment has flattened and remains below where we were at the start of the pandemic. As you can see below, despite rising consumption, consumer sentiment actually fell in the 3rd quarter as Americans became increasingly worried about inflated prices, product shortages, government spending, and the continued impact of COVID.

So, while consumer demand and spending remain strong, consumers remain wary. The 4th quarter, which is typically strong for consumer spending, will likely provide a good litmus test. Should consumer behavior fuel greater revenues, we would expect an uptick in economic growth that has the potential to carry on through the first half of next year. However, that all depends on the push and pull between pent-up demands and cash on the sidelines with continued supply-side disruptions. How far input prices rise and the velocity at which those increases are passed on to the consumer will ultimately determine the pace of economic growth.

Given these mixed signals, we believe it’s important to explore strategies that are less correlated to the broader markets. While it is essential for investors to capture as much of this market’s upside as possible, they must also temper their expectations and prepare for a less accommodating market environment. This does not mean abandoning risk assets completely but, instead, focusing on more specific sectors that can provide both growth and diversification.

Market Opportunities: Equity

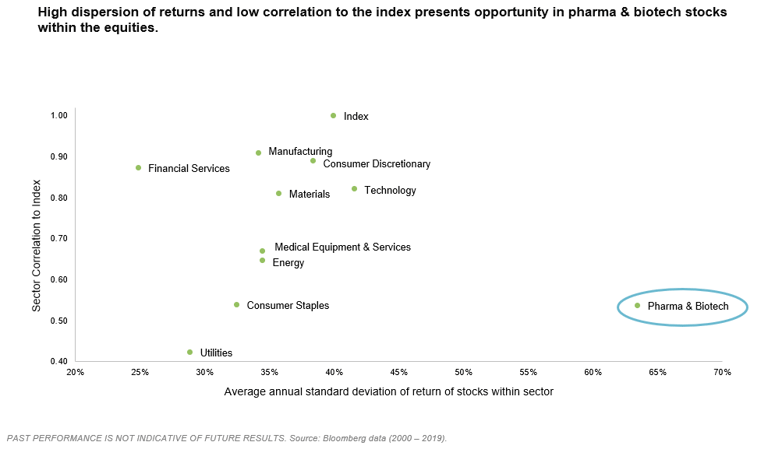

Although much of the equity markets could be characterized as overvalued based on historical data, we believe pockets of opportunity remain in specific market sectors. One of those areas, biotechnology, has the potential to provide favorable long-term outcomes. Despite recent growth, the biotech sector remains a smaller, niche market segment that most managers do not heavily traffic, given its specialized nature. Some managers will avoid this sector because they lack analysts with the experience and technical knowledge to perform the appropriate due diligence, and this lack of coverage leads to a less efficient market. Thus, there is more potential for managers to add value given the high dispersion of performance and volatility of these companies, as measured by the x-axis of the chart below. In addition, biotech equities have traditionally had a lower correlation to the broader equity market, which is reflected on the chart's y-axis. Given the recent growth in revenues for many companies in this segment, some of which resulted from the pandemic, it may seem like a difficult time to allocate capital to biotech companies. However, we believe this remains a unique opportunity with the potential for long-term growth and strong diversification benefits if you can access the right companies.

Market Opportunities: Real Assets

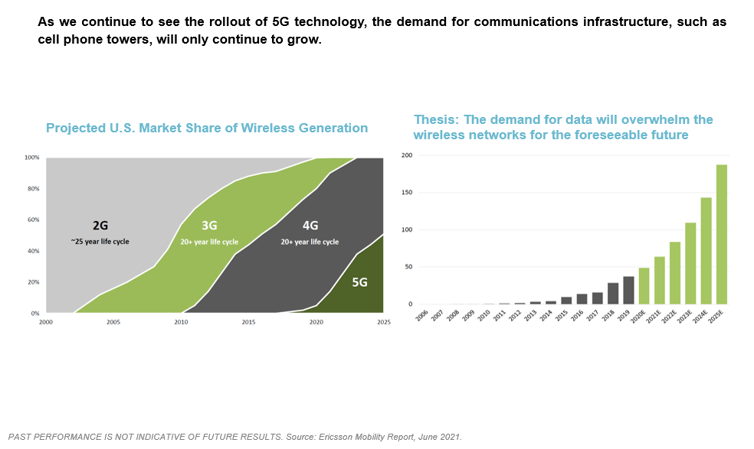

Much of the discussion this year regarding real assets has naturally revolved around commodities and natural resources due to the aforementioned issues around shipping and energy prices. One opportunity that garners less attention is the growing need for additional infrastructure within the wireless communications space. As the rollout of 5G technology continues rapidly, the demand for the infrastructure to support the growing volume of 5G capable devices is significant. Harnessing the power of 5G holds tremendous potential and the market has seen a huge uptick in use cases for this technology across a variety of verticals. North America leads the way in shaping the future of 5G adoption and expanding it across many enterprise uses. While 5G enabled global enterprise opportunity is expected to exceed $700 billion by 2030, North America will likely represent over $180 billion.

So, what does this all mean for investors and how big is this opportunity in real terms? Consumers are accessing data through wireless devices more than any time in history and this utilization continues to grow. Every minute of the day there are approximately 374,000 stories shared on Instagram, 42 million messages traded on WhatsApp, and 404,000 hours of video watched on Netflix. Social media and entertainment are only scratching the surface of 5G’s potential. Estimates show a 16% reduction in healthcare costs through remote patient monitoring tools. The manufacturing industry benefits from operating income improvements supported by AI technology, robotics, and autonomous systems. The increased connectivity of the energy grid allows for more optimal and efficient energy transfer and further utilization of solar and wind technologies. For this to come to fruition, there needs to be significant infrastructure expansion to support these 5G dependent technologies. While many investors are naturally focused on things like bandwidth and spectrum auctions, we believe the greater opportunity lies in hard infrastructure like wireless tower construction and leasing.

Our OCIO Perspective

Novelist E.L. Doctorow once wrote, “There is really no fiction or non-fiction; there is only narrative.” 2021 has truly been the year of the narrative. SPACs, stock influencers, meme stocks, and crypto. Some are good ideas, but, as a whole, they make better stories. While following the story, many investors have ignored the fundamentals, the risks, and sometimes even the potential (or lack thereof) for long-term profitability. And that has in large part been lucrative so far. Along with many investors, Verger, too, has been the beneficiary of several of these trends. But we believe investors must be prepared for when “FOMO” becomes “Oh no!” Our hope is that other savvy investors are thinking along the same lines and are preparing for that inflection point. We don’t think there’s any mystery in the fact that the majority of the equity and bond markets are overpriced and that policymakers are largely in over their heads. So, what’s an investor to do? We can’t all just go to cash and stick our heads in the sand while inflation eats away our principal. No, it means building protection into your portfolio with diversification, uncorrelated strategies, and enough readily available liquidity and dry powder to take advantage of volatility when it emerges. It’s not about being afraid of risk, it’s about being prepared for it.

As we reflect on our friend, Ted Lasso, we are reminded of a late episode in the series’ 1st season when his team teeters on the brink of relegation to a lower league. It’s at this point when one of his team’s supporters shares with Ted that “it’s the hope that kills you.” At current valuation levels, massive amounts of hope are built into equities, especially large cap U.S. equities. Historically, forward returns from valuation levels like we see today have been modest at best. So, the hope may indeed kill you – outsized forward growth expectations are likely not to be realized and even if they do, the market may compress the multiples on these higher future earnings. Either way, the path forward in equities seems fraught with challenges, regardless of investors’ hope.

At Verger, we always seek to build portfolios that can succeed across all market environments while protecting the downside rather than simply depending on one or two factors like equity multiple expansion or earnings growth. Like Ted, we are optimists at heart, and we believe there are opportunities today, even in a market with elevated valuations and a high degree of disappointment likely due to outsized growth expectations, overlooked geopolitical risk, and unfriendly tax policies. Nonetheless, we agree with Ted when he says, “don’t let the wisdom of age be wasted on you.” So, with experience, discipline, diversification, and a little help from the Fed, we believe.

Source: Apple TV+

Source: Apple TV+

All investments involve risk, including possible loss of principal.

Not all strategies are appropriate for all investors. There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives. Diversification does not ensure a profit or protect against a loss.

One cannot invest directly in an index, and unmanaged indices do not incur fees and expenses.

This article is being provided for informational purposes only and constitutes neither an offer to sell nor a solicitation of an offer to buy securities. Offerings of securities are only made by delivery of the prospectus or confidential offering materials of the relevant fund or pool, which describe certain risks related to an investment in the securities and which qualify in their entirety the information set forth herein. Statements made herein may be materially different from those in the prospectus or confidential offering materials of a fund or pool.

This article is not investment or tax advice and should not be relied on as such. Verger Capital Management (“Verger”) specifically disclaims any duty to update this article. Opinions expressed herein are those of Verger and are not a recommendation to buy or sell any securities.

This article may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although Verger believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed. Except where otherwise indicated, all of the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor's fees or other trading expenses.