The past 18 months have been unusual, to say the least; in the last year and half we have seen several global and investment related events that included many outliers. In our recent quarterly investment update, we took advantage of the opportunity to highlight the interesting parallels between some of the global investment trends and Malcolm Gladwell’s book, Outliers. At its core, the book focuses on the difficulty in identifying and interpreting a variety of factors that individually, or in concert, serve as catalysts for success. Similarly, we explore how the markets responded to a global pandemic that, somewhat counterintuitively, resulted in a spectacular market appreciation in the face of so many seemingly negative variables.

Verger’s quarterly investment webinar is open to qualified investors only. To request an invitation to next quarter’s call, please contact us using the form found here.

Market Review

As we review the past quarter and fiscal year, one overarching theme continues to be the impact of the global pandemic. During the onset of the pandemic in early 2020, economies were shut down with unprecedented severity and speed and financial markets declined sharply in response. That turmoil seems like a distant memory following equally unprecedented government stimulus, record low interest rates, and the advent of a vaccine that led to swift (if still partial) economic recoveries, including eye-popping returns for many investors.

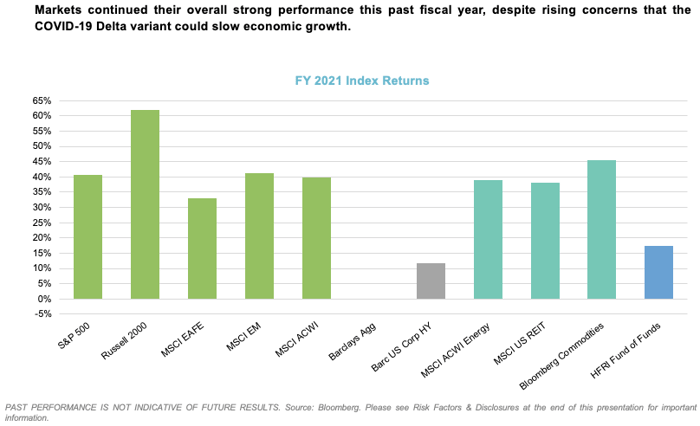

While owners of bonds endured negligible real returns with interest rates near zero, those invested in equities prospered greatly. For the year ended June 30, 2021, most equity indices returned 30% or more. As evidenced by the chart below, the S&P 500 and Emerging Markets indices both increased over 40% while U.S. Small Caps outpaced most indices, up over 60%. Even sectors like Energy, Real Estate and Commodities, which struggled in the initial months of the pandemic, recovered quickly to keep pace with equity performance. And while hedge fund strategies tended to trail the liquid markets, many investors benefited from exposure to private equity and venture capital, with some experiencing multiple liquidity events in their portfolios. All of this in the face of continued uncertainty, including lower travel demand, supply chain issues, uneven openings, and new concerns around public health.

The Alpha Nasdaq Endowments & Foundations Index, which is based on performance data from 43 OCIO firms representing approximately 400 endowments and foundations, was up 27.3% for fiscal year 2021. According to data from Wilshire Trust Universe Comparison Service, college and university endowments posted their strongest annual performance in 35 years, with a 2021 fiscal year median return of 27%. By comparison, Wilshire reports the median U.S. college and university endowment returns for fiscal year 2020 at 2.6% and fiscal year 2019 at 6%.

The market response to the pandemic and other variables over the last twelve to eighteen months has been unique – an outlier – particularly when considering performance in comparison to history. The question now is what should investors expect going forward?

Market Outlook

Throughout the turmoil of the past year, one underlying theme has remained true: diversification is still the only free lunch. While concentration in those markets that outperformed substantially would be ideal, nobody can predict the timing of turning points in the markets – nor the amplitude, intensity, shape, and depth of those turning points. We believe diversification is the path forward, as we strive to maintain an all-weather portfolio designed to protect, perform, and provide – particularly considering the future opportunity set.

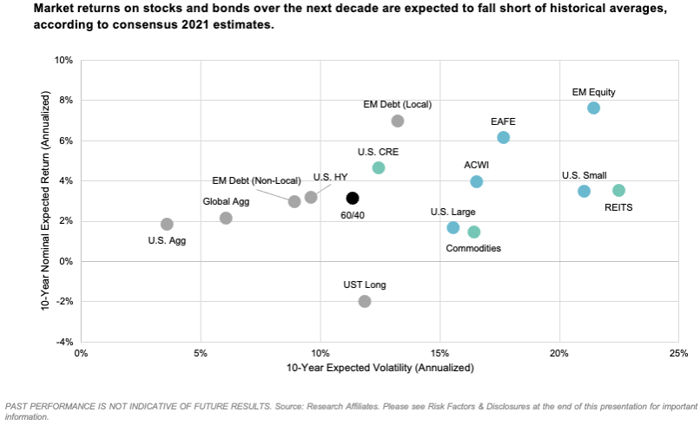

Over the past decade, an environment of low interest rates and extended equity valuations has benefited investors. However, looking forward, consensus 10-year risk and return expectations paint a different picture.

Think of the 60/40 portfolio (the black dot in the middle of the chart above) as the family minivan – sturdy and reliable, something to get you from Point A to Point B. This traditional portfolio of 60% stocks and 40% bonds was meant to solve the twin objectives of long-term capital appreciation and capital preservation. Given today’s valuations, that 60/40 portfolio is likely to achieve neither with annualized expected returns under 4% and volatility over 12% over the next decade. Inflation alone is enough to offset any bond returns and there is little benefit to adding risk through equities, given the expected return premium over fixed income is minimal. Simply put, expected returns are low, expected volatility is high, and the risk premium paid to investors in traditional asset classes is likely low.

While this all presents a challenge for investors, we aren’t hopeless. We remain confident that diversification into non-traditional asset classes will provide a less bumpy ride while helping to capture any opportunities that may result as the market shifts.

Market Opportunities

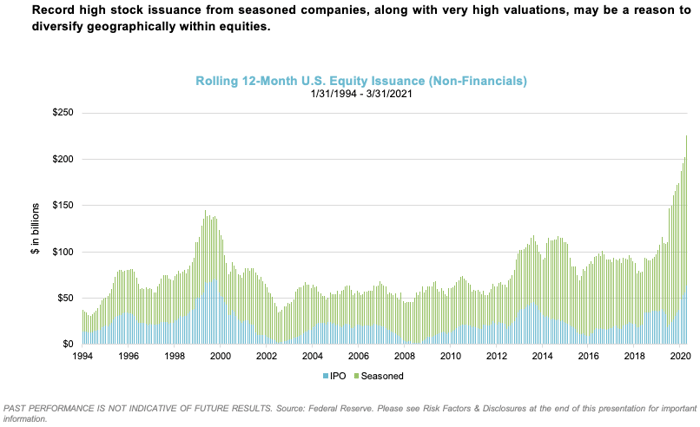

A common saying on trading desks is “Feed the ducks while they’re quacking.” In other words, when the market presents a ravenous demand for an asset, the best strategy for holders of that asset is to sell into that demand – feed the ducks. In today’s market environment, there is ample opportunity to feed the ducks, particularly in equities. Looking at the tail end of the chart below, we notice that U.S. equity issuance has greatly increased over the past 12 months. A part of this story that may be underappreciated is the number of new issuances made by seasoned (or non-IPO) companies. The last time we encountered a spike like this was in the late 90’s, near the tail end of the tech bubble.

While we are not predicting an immediate decline in U.S. equities, we believe this record stock issuance, coupled with inflated valuations, is another reason to continue to diversify geographically.

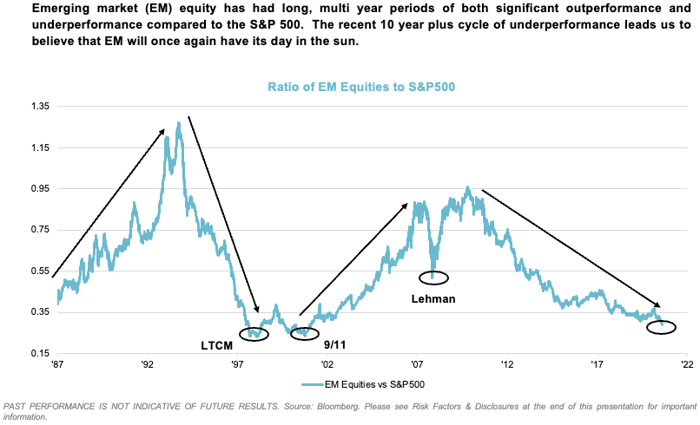

One diversification opportunity of particular interest is emerging market equities. Historically, emerging market equities have experienced multi-year periods of both underperformance and outperformance versus domestic equities. The past decade or so represents a period of significant underperformance, which signals the potential for a period of outperformance going forward.

While timing these market shifts is all but impossible, we know that allocating to assets that are undervalued in comparison to their peers has historically led to positive long-term outcomes. Given the cyclical nature of the relationship between U.S. equities and emerging markets, we believe that now is a good time to allocate to emerging market equities. Investing in the equity markets of out-of-favor economies like Greece and Brazil is a unique opportunity to both diversify geographically and capture performance that may potentially outpace U.S. equities should these markets swing back into favor.

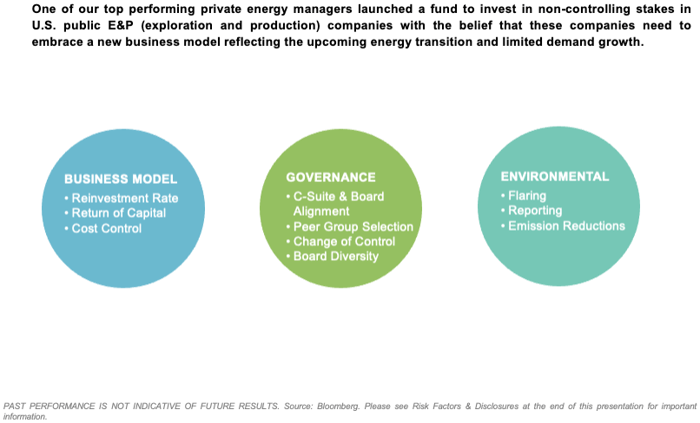

Another area of opportunity we have identified is energy, particularly publicly listed exploration and production firms. Although this market has recovered from the depths of the sell-off that immediately followed the onset of the pandemic, many of these companies have underperformed the broader equity market for several years. We believe this sector’s underperformance has come as a result of management pursuing growth over profitability along with misaligned incentives that lead to uneconomic investments, excessive costs, and inflated balance sheets.

Our thesis is that through small tweaks to the business model and improved corporate governance, these companies are well positioned to rebound. Thus, we have partnered with a manager that is helping companies embrace a new business model focused on lower costs, alignment of management incentives, lower capital reinvestment, and the return of cash to shareholders through sustainable dividends. We believe this strategy, when paired with a willingness to accept the eventual transition to more environmentally sustainable practices and energy sourcing, provides a unique opportunity for this subset of companies in the energy sector.

Conclusion

In the author’s note to Outliers, Malcolm Gladwell reveals that the impetus for writing the book grew out of a frustration of attempting to explain the careers of successful people. It seemed that the conventional wisdom of what makes people successful was merely a crude, anecdotal understanding of the roots of success. He believed there was an opportunity to dig deeper and better understand the true catalysts. That’s something we attempt to embrace every day at Verger. Approach problems from different angles. Investigate different drivers of return. Be willing to be a contrarian.

Outliers is not a roadmap for success and a traditional 60/40 portfolio is not a playbook to achieve 8% returns. Social psychologist Roy Baumeister states “Illusions, distortions, and self-deception appear to be integral to the way normal, well-adjusted people perceive the world.” We all need a bit of delusion to be an investor these days in the age of GameStop, cryptocurrencies, NFTs, and even particular government bond issues. However, we must also be grounded enough to recognize that all markets eventually eschew irrational exuberance. Often, the best path to success is to avoid obvious mistakes. The most obvious mistake we can make today is assuming that the future will look just like the past.

Verger Highlights

While the past year has been difficult for many, Verger has achieved significant milestones that we would be remiss not to share. Verger celebrated seven years since the firm was founded, cementing a notable track record of performance. We also recently completed the verification process that allows us to claim compliance with the Global Investment Performance Standards (GIPS®). While GIPS compliance is not mandatory, we take great pride in holding ourselves to these globally accepted standards and promoting greater transparency.

Finally, signaling the continued growth and success of both our clients and Verger, in the second quarter of 2021 we reached over $2.3 billion in assets under management, partially resulting from meaningful growth in client portfolios. It is a privilege to serve our clients, their missions, and their constituents. As always, we appreciate their confidence in Verger as we work to support our own mission to invest in the lives of others.

All investments involve risk, including possible loss of principal.

Not all strategies are appropriate for all investors. There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives. Diversification does not ensure a profit or protect against a loss.

One cannot invest directly in an index, and unmanaged indices do not incur fees and expenses.

This article is being provided for informational purposes only and constitutes neither an offer to sell nor a solicitation of an offer to buy securities. Offerings of securities are only made by delivery of the prospectus or confidential offering materials of the relevant fund or pool, which describe certain risks related to an investment in the securities and which qualify in their entirety the information set forth herein. Statements made herein may be materially different from those in the prospectus or confidential offering materials of a fund or pool.

This article is not investment or tax advice and should not be relied on as such. Verger Capital Management (“Verger”) specifically disclaims any duty to update this article. Opinions expressed herein are those of Verger and are not a recommendation to buy or sell any securities.

This article may contain forward-looking statements relating to future events. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although Verger believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed. Except where otherwise indicated, all of the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor's fees or other trading expenses.